|

LITHIUM & COBALT

Please use our A-Z INDEX to navigate this site or see HOME

|

||

RAW MATERIALS

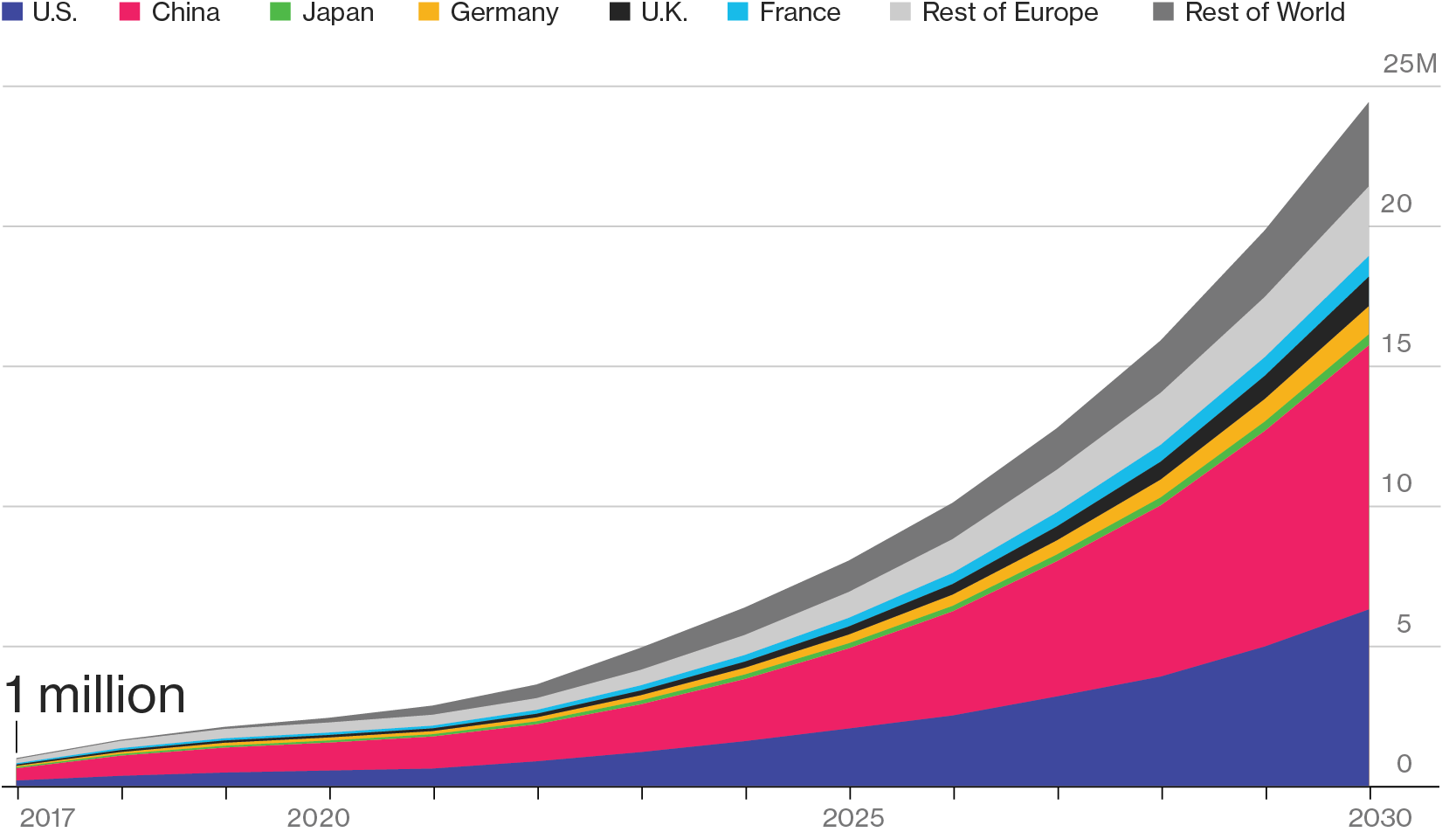

Anxiety about lithium’s availability has caused its price to spike. In 2010, lithium sold for $5,180 per metric ton. By 2012, the cost was over $6,000 per metric ton, and by the end of 2017, a metric ton was going for about $14,000 – a 270 percent increase over 2010 levels. Figure 3 (Source: USGS) demonstrates this sharp increase in prices.

While devices that contain lithium can be recycled, there is no recycling technology capable of yielding lithium pure enough for use in new lithium ion batteries. Going forward, lithium-consuming industries will need to collaborate in order to develop a recycling processes and infrastructure that can better recover lithium and the other precious materials that go into lithium ion batteries.

TESLA S CARTRIDGE EXAMPLE - There’s about 12kg of Lithium in a 70kWhr Tesla battery (63kg of Lithium Carbonate which is 12kg of Lithium as lithium is about 19% of a Lithium Carbonate Li2CO3 molecule by weight.)

There are about 35M Tonnes (or 35B kg) or 2.9B batteries worth, which at 100M cars per year is 29yrs, ok maybe I used 95M cars per year. Anyway, we’re talking almost 30yrs worth for every car to be made and use Li-ion batteries, with the known reserves. The reality is, there is likely much much more reserves but the value to go hunt them out is very limited, after all it’s pretty much ceramic glaze, glass, lithium grease, and at the rate of consumption the supply was near endless. So if/when we get to near this kind of consumption rate, we’ll definitely start looking for more.

But that said, there are many other readily available elements that can be used just as well as Lithium to create a electrolyte that’s as good or close to it. Technology keeps improving as well, many Li-ion battery techs with less Lithium, higher energy density, faster charging rates, have already been identified, the question is manufacturing cost.

And the most important thing, is it’s very easy to recover nearly 100% of the lithium carbonate in these batteries. Tesla using the 18650 (looks like a larger AA) battery is going to be extremely easy to do. Simply open up the main battery, take out the packs, open them up, dump the 18650’s in a hopper, send them down the line to be de-capped and extract the Lithium Carbonate. This is already part of Tesla’s plans with the Gigafactories and recycling of these batteries will be mandated, and much easier to enforce than the lead acid battery under you ICE vehicles hood.

LITHIUM MINING

North America has only one lithium mine, the Albermarle Silver Peak Mine, and only one U.S. company is currently producing lithium from brine. Most of the world’s lithium comes from brine operations in Chile and a spodumene operation in Australia. China and Argentina are also major lithium producers. Establishing a reliable, diversified supply of lithium is a top priority for technology companies in the United States and Asia, particularly battery suppliers and vehicle manufacturers, and numerous lithium claims have been leased or staked worldwide. Brine operations are under development in Argentina, Bolivia, Chile, and the United States; spodumene mining operations are under development in Australia, Canada, China, and Finland; a jadarite mining operation is under development in Serbia; and a lithium clay-mining operation is under development in Mexico.

COBALT

MINING GUARDIAN JULY 2017

Trent Mell of First Cobalt, a Toronto-based mining company, said: “Cobalt is tricky because of the scarcity of supply. There aren’t a lot of producers. We’re relying on more discoveries. It’s out there: we’ve just got to find it.”

This is the mother of supply chain headaches, and one hi-tech car manufacturers and electronics firms could do without. At the heart of the global cobalt trade is Glencore. The metals and mining giant produces almost a third (28,300 tonnes) of the world’s annual supply. As much as 65% of this global supply comes from the Democratic Republic of Congo (DRC), where cobalt production has fallen this year because of the unstable political situation. This sparked a 90% jump in the price of cobalt to a peak of $61,000 a tonne earlier this month.

Macquarie Research predicts that trouble in the DRC and rising demand for electric vehicles will lead to a four-year-long cobalt shortage. Writing in academic journal The Conversation, Ben McLellan, senior research fellow at Kyoto University, warned further: “Manufacturers such as electric vehicle makers should be concerned that the supply of one of the key mineral components, or the processing and refining infrastructure, could become too centralised in a single country. Without diverse source options, the possibility of supply restriction becomes more likely.”

The squeeze on cobalt has sent car giants such as Volkswagen scurrying to lock in supply deals with the likes of Glencore. First Cobalt’s Mell said: “I think there is going to be some jockeying for supply.”

Two South Korean battery makers – Samsung SDI and LG Chem – have responded to the crisis by stepping up development of new power packs that use more nickel and less cobalt.

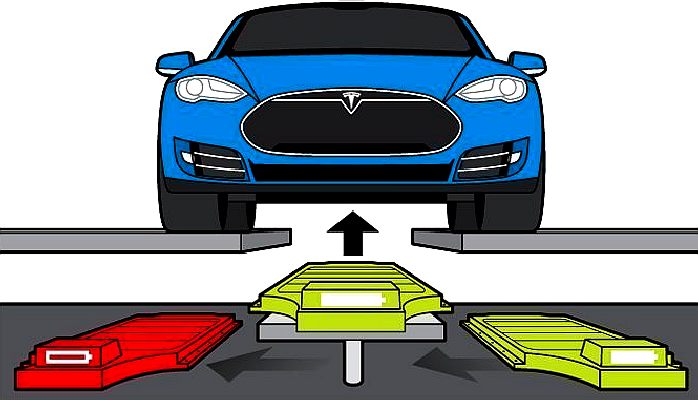

TESLA S CARTRIDGE EXCHANGE - This concept is not a million miles away from SMARTNET, except that the underground method makes it expensive and complicated. This is a variation of the Better Place system. The point here is that with a bit of tweaking, FASTCHARGE can be made to work in practical terms.

PRIOR ART

1900 - Cartridges as an energy transfer medium were first used by Professor Porsche in the early 1900s. He then increased range with petrol dynamo and gave up when petrol cars got electric starter motors.

1990 - Buses with cartridge exchange were used at Kobe, Japan, in the 1990s.

2009 - The next serious attempt to perfect the concept came with Shai Agassi's 'Better Place' system, using service stations in Denmark and Israel, but only for batteries as the energy storage medium. The service stations were expensive and the loading mechanism complicated, but were still planned for California, but the company folded in 2013.

2013 - Elon Musk came next with a Tesla S production vehicle modified to swap cartridges. Once again the underground (or above ground stage) required expensive installations, and this system was only for battery cartridges. Tesla is now concentrating on rapid charge stations.

The proposed SmartNet FastCharge system aims to resolve the issues identified from the Better Place and Tesla systems, by incorporating fuel cells in standard cartridges as future proofing and reducing the buy in cost with networked flat pack service stations that any utility, supermarket or energy company might operate.

CONTACTS

Solar House BN27 1RF, United Kingdom PIC No: 895922168

LINKS & REFERENCE

https://www.theguardian.com/environment/2017/jul/29/electric-cars-battery-manufacturing-cobalt-mining https://blog.energybrainpool.com/en/is-there-enough-lithium-to-feed-the-need-for-batteries/ https://www.bloomberg.com/graphics/2017-lithium-battery-future/ https://ec.europa.eu/easme/en/section/sme-instrument/eic-accelerator-sme-instrument-funding-opportunities

Please use our A-Z INDEX to navigate this site

|

||

|

This website is provided on a free basis as a public information service. copyright © Climate Change Trust 2021. Solar Studios, BN271RF, United Kingdom.

|