|

CRYPTOCURRENCIES

-

CLIMATE CRIMINALS

Please use our A-Z INDEX

to navigate this site

BOGUS

TRADING -

In our view, there is no such thing as perpetual motion,

including in the world of money. It is utter nonsense to

suggest that money can be made, without someone somewhere

actually producing something - working for a living. The suggestion that we can all

be $millionaires using supercomputers to undermine real world

values is crazy. Then who is farming

our crops, building our homes and making our vehicles? Only

someone who has not worked for a living could dream up and

sanction such an immoral way of leaching off society.

SMART ENERGY INTERNATIONAL

17 NOV 2021 - SWEDEN - CALL FOR BAN ON EU CRYPTOMINING

Sweden’s Financial Supervisory Authority and Environmental Protection Agency call for more energy efficient approaches to crypto asset extraction.

In an opinion piece in the Swedish newspaper Dagens Nyheter, the directors general of the two organisations, Erik Thedéen from the FI and Björn Risinger from the EPA, argue that the growing interest in energy-intensive Bitcoin and Ethereum mining is threatening the country’s ability to achieve its

Paris Agreement goals.

A ban is needed on the extraction of crypto assets that use a lot of energy, they say, proposing that the EU should investigate banning the energy-intensive method of extraction and that in the meantime Sweden should counteracts the broad establishment of crypto mining nationally.

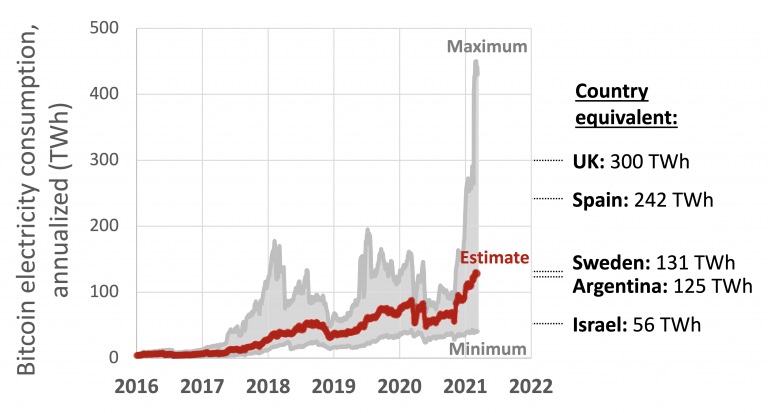

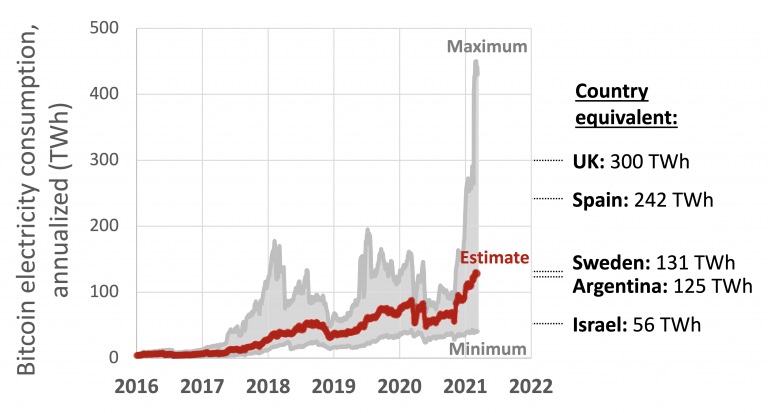

The two directors-general state that estimates of the consumption of mining for Bitcoin and Ethereum are about double Sweden’s annual

electricity consumption.

Moreover, with the push towards cryptomining with renewable energies, eyes are on the Nordic region, where prices are low, taxation is favourable and the availability of

renewable energy is good.

Between April and August this year, electricity consumption for the extraction of Bitcoin in Sweden increased by several hundred percent and now amounts to 1TWh on an annual basis.

“This corresponds to the household electricity of 200,000 households. It is a development that we need to stop.

“If we were to allow large extraction of crypto assets in Sweden, we run the risk that our

renewable energy will not be enough for the crucial climate changes that we need to make, like producing fossil-free

steel, large-scale battery production and electrification of our transport sector.”

Thedéen and Risinger say their conclusion is that the method currently used to extract Bitcoin and Ethereum must be regulated, with one option being a climate tax on energy-efficient mining.

Both the EU and Sweden need to be clear that our renewable energy should be used where it is most beneficial to society as a whole, they say.

Were the EU to take such as step, it would not be the first to do so as

China has already implemented a ban. However, it is likely to be hotly debated, with opposition emerging from the Swedish Bitcoin Association, while Mathias Sundin, President of the Future Foundation Warp Institute, has suggested it would be more effective to stop

gold mining than cryptocurrencies.

“Cryptocurrencies change the world as much as the internet,” signals Totte Löfström, CEO of the Swedish cryptocurrency exchange Trijo.

Apparently,

the sovereign nation, El Salvador, announced that bitcoin would become its national currency instead of the US dollar. This is madness, as you could find the value of your local assets dependent upon the unruly trading of an unregulated and unstructured token.

How then could you trade reliably?

A limited supply - These tokens have to be 'mined' through the use of computer algorithms. Their supply is going to be extremely limited and the power necessary is astonishing.

According to Digiconomist, as of July 15, a single bitcoin block requires 1,721.96 kilowatt-hours, or nearly $26,000 (£19,318).

Put it all together and bitcoin requires as much power as used by the country of Sweden each year.

The outlook for cryptos - For the real value, we must look at the underlying structure of these tokens.

They run on a structure – blockchain – which is best described as a spider's web. If any part of the web is touched, the rest of the web or network will be aware of it. In effect it makes the recording and control of the system locked in. So we are now seeing central banks, including the Bank of England, looking to see if they should run their own cryptocurrency.

This could allow the Bank to have total control and oversight of all trading ownership and transfer of their own cryptocurrency. This would then prevent money laundering and control any potential illegal action involving their own assets within the spider's web.

What should we do? - In our view cryptocurrencies should not form part of a portfolio as they are as yet not properly regulated and their value is far too erratic.

However if you wish to have a bet then this is a financial version of a day at the races – except it comes without the picnic and champagne.

For proper investment, we should wait until this market of computer-generated tokens matures into a more reliable

(perhaps tangibly linked to grain, fruit harvests or livestock

values) asset. From an article by Justin Urquhart Stewart (for Daily

Mail).

COMPUTER

PROGRAMS & SEARCH ENGINES

Computers use energy to run

their programs. The more complex a program, the more computing

power and so more energy is needed. We are bombarded by

advertising from programs that are built into operating

systems and search engines - all aimed at selling you goods

and stealing your information - to be able to do so.

Companies

that use computers to undermine your privacy in an efforts to

sell you more goods than you need or want are pumping up

greenhouse gases. These corporations include Amazon, Apple,

Ebay, Google and Microsoft, to name just a few. These are the

soft climate criminals, who think it is okay to raise the

temperature of planet earth, to increase their profits. Billionaires

like Bill Gates do not need the money and giver very little

back to society in relation to the wealth they created from computers.

You

may find these commercial gambits entertaining, but they are

costing the earth in terms of energy consumption. Morality

demands that computer manufacturers and software producers

should limit the complexity of their wares, to limit global

warming.

UNEARNED INCOME

Unearned income that is not

based on anything real or tangible in terms of earth's natural

capacities should be outlawed as immoral earnings, like drug

dealing, prostitution, child labour and financial

slavery. Such practices are undermining the natural

balance of nature.

Currencies should be linked to

something tangible like farming produce and energy production, in the absence of a

Gold Standard. The moment we allowed banks to print money

without anything to back that up, we took the stony path to

climate damnation.

Humans are inherently lazy,

stemming from our intelligence, and what we can get away with.

Why should we work for a living, when we can use the system to

get (enslave) others to work for us.

Banks and bankers are the lowest

form of human life in this respect. They want to shuffle paper

and push keyboard buttons, rather than dig foundations and lay

bricks. Where they want big profits, rather than a reasonable

rate of return, they are non-productive parasites on society.

Not much better than bank robbers, who at least have to plan a

heist and execute it. I.e., do something physical.

Cryptocurrencies and bitcoin

mining have taken this to the next level of immorality. Why

then is it not illegal, like cocaine and heroin?

What

chance have we. We doubt the G7 will ever be able to change,

meaning COP 26 will be FLOP26,

leading to FLOP27.

Countries that condone immoral earnings, are nothing less than

Climate

Nazis Laws need to be

implemented to track and trace bitcoin miners and other

cryptocurrency developers. It must be made illegal to operate

computers that use huge amounts of energy for what amounts to

gambling with our climate.

Studies published earlier this year found bitcoin mining operations have a carbon footprint equal to some European nations, raising concern about the environmental impact cryptocurrencies will have on the planet.

BBC NEWS 8 APRIL 2021 - STUDY SAY BICOIN COULD DERAIL CHINA'S CLIMATE CHANGE TARGETS

Bitcoin mining in China is so carbon intensive that it could threaten the country's emissions reduction targets, according to new research.

China wants its emissions to peak in 2030, and has plans to be carbon neutral by 2060.

The cryptocurrency's carbon footprint is as large as one of China's ten largest cities, the study found.

China accounts for more than 75% of bitcoin mining around the world, researchers said.

The study was written by academics from the University of the Chinese Academy of Sciences, Tsinghua University, Cornell University and the University of Surrey. It was published by the peer-reviewed journal Nature Communications.

"Without appropriate interventions and feasible policies, the intensive bitcoin blockchain operation in China can quickly grow as a threat that could potentially undermine the emission reduction effort taken place in the country," it warned.

Some rural areas in China are popular among bitcoin miners, mainly due to the cheaper electricity prices and undeveloped land to house the servers.

Miners play a dual role, effectively auditing bitcoin transactions in exchange for the opportunity to acquire the digital currency.

The process requires enormous computing power, and in turn consumes huge amounts of energy.

Already, bitcoin-related emissions in China exceed the total emissions of the Czech Republic and Qatar in 2016.

By 2024, China's bitcoin operations will exceed the total energy consumption of Italy and Saudi Arabia, and would rank 12th among nations.

At its peak, it could account for about 5.41% of China's electricity generation emissions.

The researchers said a carbon tax would be relatively ineffective for bitcoin, and suggested "site regulation" policies instead.

'Chinese financial weapon'

The researchers said the "attractive financial incentive of bitcoin mining" has caused an arms race in dedicated mining hardware

The price of the cryptocurrency surged during the pandemic, rising from $7,000 last April to pass $60,000 in March before hitting a period of volatility.

Bitcoin's price increase was pushed higher by well-known companies adopting it as a method of payment, including electric carmaker

Tesla.

The Covid-19 pandemic also likely played a part, with more people shopping online and moving further away from physical currencies.

Critics have long charged that in addition to its environmental impact, its main use is as a financial speculation tool rather than as a currency.

They also worry that it is prone to market manipulation by a few large players.

UNITED

NATIONS IPCC CODE RED -

The Intergovernmental Panel on Climate Change (IPCC) is the United Nations body for assessing the science related to climate change.

Having declared a Code Red, we wonder how that equated to the

Defense Readiness Condition, better known as the "Defcon"

warning system, in terms of war footing. Crypto scammers are

are undermining the already insecure currencies of legitimate

banking, ignoring for now that banking has itself abandoned

any genuine back-up for those accepting paper notes, and

digital transactions based on those theoretical paper

promises.

COLUMBIA CLIMATE SCHOOL - SEPTEMBER 2021

In April of 2011, the price of one bitcoin was $1; this April it reached an all-time high of almost $65,000, and as of this writing each one is worth approximately $48,000. Because some bitcoin investors have become millionaires overnight, more and more people are intrigued by the possibility of striking it rich through investing in cryptocurrencies like Bitcoin. But Bitcoin’s rising popularity may make it impossible for the world to stave off the worst impacts of climate change, because the energy consumption of this cryptocurrency is enormous and its environmental implications are far-reaching.

To understand Bitcoin’s environmental impacts, we first need to know what it is and how it works.

What is Bitcoin?

A cryptocurrency is a virtual medium of exchange that exists only electronically; it has no physical counterpart such as a coin or dollar bill, and no money has been staked to start it. R.A. Farrokhnia, Columbia Business School professor and executive director of the Columbia Fintech Initiative, said, “It’s a marketplace and as long as people are willing to assign value to it, then that’s it.” Bitcoin, the largest cryptocurrency in the world, accounting for more than half of all cryptocurrency, can be used to buy cars, furnishings, vacations and much more. This month, the world’s bitcoins were worth $903 billion.

Cryptocurrencies are decentralized, meaning that there is no central authority like a bank or government to regulate them. The advantage of this is that there are no transaction fees, anyone can use it, and it makes transactions like sending money across national borders simpler. While transactions are tracked, the people making them remain anonymous. This anonymity and lack of centralized regulation, however, means that tax evaders, criminals, and terrorists can also potentially use cryptocurrencies for nefarious purposes.

Without physical money or a central authority, cryptocurrencies had to find a way to ensure that transactions were secure and that their tokens could not be spent more than once. Bitcoin was born in 2008 when a mysterious person (or persons) named Satoshi Nakamoto (whose true identity remains unknown), found a solution to these issues. Nakamoto’s answer was a digital ledger system with trust in the system achieved through mathematics and cryptography, and with transactions recorded in blockchain. Blockchain is a transparent database that is shared across a network with all transactions recorded in blocks linked together. Nodes—powerful computers connected to the other computers in the network—run the Bitcoin software and validate transactions and blocks. Each node has a copy of the entire blockchain with a history of every transaction that has been executed on it.

Nakamoto capped the number of bitcoins that could be created at 21 million. While there is speculation about the math theories that led to the choice of that number, no one really knows the reason behind it. As of this month, an estimated 18.8 million bitcoins were in circulation; it’s expected that all remaining bitcoins will be released by 2140.

How do bitcoins enter circulation?

New bitcoins are released through mining, which is actually the process of validating and recording new transactions in the blockchain. The miner who achieves this first is rewarded with new bitcoin.

Miners must verify the validity of a number of bitcoin transactions which are bundled into a block. This involves checking 20-30 different variables, such as address, name, timestamp, making sure senders have enough value in their accounts and that they have not already spent it, etc. Miners then compete to be the first to have their validation accepted by solving a puzzle of sorts. The puzzle involves coming up with a number—called the nonce, for ‘number used once’—that when combined with the data in the block and run through a specific algorithm generates a random 64-digit string of numbers and letters. This random number must be less than or equal to the 64-digit target set by the system, known as the target hash. Once the nonce is found that generates the target hash, the winning miner’s new block is linked to the previous block so that all blocks are chained together. This makes the network tamper-proof because changing one block would change all subsequent blocks. The result is broadcast to the rest of the blockchain network and all nodes then update their copies of the blockchain. This validation process, or consensus mechanism, is known as proof of work.The winning miner receives newly minted bitcoin as well as transaction fees paid by the sender.

The higher the price of bitcoin, the more miners are competing, and the harder the puzzles get. The Bitcoin protocol aims to have blocks of transactions mined every ten minutes, so if there are more miners on the network with more computing power, the probability of finding the nonce in less than ten minutes increases. The system then makes the target hash more difficult to find by adding more zeroes to the front of it; the more zeros at the front of the target hash, the lower that number is, and the harder it is to generate a random number below it. If there is less computing power operating, the system makes the puzzle easier by removing zeroes. The Bitcoin network adjusts the difficulty of mining about every two weeks to keep block production to ten minutes.

Every 210,000 blocks, the bitcoin reward for miners is halved. According to Investopedia, when bitcoin was first mined in 2009, mining one block would earn 50 bitcoins. By November of 2020, the reward was 6.25 bitcoins, but the price was about $17,900 per bitcoin, so a miner would earn $111,875 (6.25 x 17,900) for completing a block.

It’s estimated that there are one million bitcoin miners operating and competing, though it’s impossible to be sure because miners with less computing power of their own can join mining pools, which need not report how many active miners they have.

“I have a suspicion that Nakamoto had the notion that everyone could be a miner—that you could mine with nothing more than your laptop,” said Farrokhnia. “But as Bitcoin became more popular and more people got on the system and the rewards were actually worth money, you began to see the advent of these mining pools which significantly increased the difficulty level. This turned into a vicious cycle—an arms race—to have the most powerful computers, but then the more powerful hardware miners have, the more difficult it is to find the nonce.”

This intense competition is where the environmental impacts of Bitcoin come in.

BITCOIN'S ENVIRONMENTAL IMPACTS

Energy consumption and greenhouse gas emissions

The process of trying to come up with the right nonce that will generate the target hash is basically trial and error—in the manner of a thief trying random passwords to hack yours—and can take trillions of tries. With hundreds of thousands or more computers churning out guesses, Bitcoin is thought to consume 707 kwH per transaction. In addition, the computers consume additional energy because they generate heat and need to be kept cool. And while it’s impossible to know exactly how much electricity Bitcoin uses because different computers and cooling systems have varying levels of energy efficiency, a University of Cambridge analysis estimated that bitcoin mining consumes 121.36 terawatt hours a year. This is more than all of Argentina consumes, or more than the consumption of Google, Apple, Facebook and Microsoft combined.

And it is only getting worse because miners must continually increase their computing power to compete with other miners. Moreover, because rewards are continually cut in half, to make mining financially worthwhile, miners have to process more transactions or reduce the amount of electricity they use. As a result, miners need to seek out the cheapest electricity and upgrade to faster, more energy-intensive computers. Between 2015 and March of 2021, Bitcoin energy consumption increased almost 62-fold. According to Cambridge University, only 39 percent of this energy comes from renewable sources, and that is mostly from hydropower, which can have harmful impacts on ecosystems and biodiversity.

In 2020, China controlled over 65 percent of the global processing power that runs the Bitcoin network; miners took advantage of its cheap electricity from hydropower and dirty coal power plants. Recently, however, China cracked down on mining out of concerns about cryptocurrency’s financial risks and enormous energy consumption that works against China’s goal to be carbon neutral by 2060. As a result, many Chinese bitcoin miners are trying to move operations to other countries, like Kazakhstan, which relies mainly on fossil fuels for electricity, and the U.S. A number of U.S. states are eager to attract Chinese miners to boost their own economies. If the miners are unable to move, however, they are selling their equipment to other miners across the globe. U.S. miners themselves are raising hundreds of millions of dollars to invest in bitcoin mining and converting abandoned factories and power plants into large bitcoin mining facilities.

One example of this is Greenidge Generation, a former coal power plant in Dresden, New York that converted to natural gas and began bitcoin mining. When it became one of the largest cryptocurrency mines in the U.S., its greenhouse gas emissions increased almost ten-fold between 2019 and 2020. Greenidge plans to double its mining capacity by July, then double it again by 2022 and wants to convert more power plants to mining by 2025. While Greenidge pledged to become carbon neutral in June through purchasing carbon offsets, the fact remains that without bitcoin mining, the plant would probably not be running at all. Other polluting peaker plants—power plants that usually only run during peak demand for a few hours a month—are being taken over for crypto mining to run 24/7.

Earth Justice and the Sierra Club sent a letter to the NYS Department of Environmental Conservation urging it to reject the renewal of Greenidge’s permit that would allow it to increase its greenhouse gas emissions. They also warned that there are almost 30 power plants in upstate New York that could potentially be converted to bitcoin mining operations; if this occurred, it could foil New York State’s efforts to eliminate virtually all greenhouse gas emissions by 2050.

Globally, Bitcoin’s power consumption has dire implications for climate change and achieving the goals of the Paris Accord because it translates into an estimated 22 to 22.9 million metric tons of

CO2 emissions each year—equivalent to the CO2 emissions from the energy use of 2.6 to 2.7 billion homes for one year. One study warned that Bitcoin could push global warming beyond 2°C. Another estimated that bitcoin mining in China alone could generate 130 million metric tons of CO2 by 2024. With more mining moving to the U.S. and other countries, however, this amount could grow even larger unless more renewable energy is used.

Water issues and e-waste

Power plants such as Greenidge also consume large amounts of water. Greenidge draws up to 139 million gallons of fresh water out of Seneca Lake each day to cool the plant and discharges it some 30 to 50° F hotter than the lake’s average temperature, endangering the lake’s wildlife and ecology. Its large intake pipes also suck in and kill larvae, fish and other wildlife.

And even if it one day becomes possible to run all bitcoin mining on renewable energy, its e-waste problem remains. To be competitive, miners want the most efficient hardware, capable of processing the most computations per unit of energy. This specialized hardware becomes obsolete every 1.5 years and can’t be reprogrammed to do anything else. It’s estimated that the Bitcoin network generates 11.5 kilotons of e-waste each year, adding to our already huge e-waste problem.

NFTs

Since December, a new phenomenon in the art world has added to the environmental concerns about cryptocurrencies: NFTs. These are non-fungible tokens—digital files of photos, music, videos or other kinds of artwork stamped with unique strings of code. People can view or copy NFTs, but there is only one unique NFT that belongs to the buyer and is stored on the blockchain and secured with the same energy-intensive proof of work process. NFTs are selling for hundreds of thousands of dollars; Beeple, a digital artist, sold one NFT for more than $69 million.

Ethereum, the second most popular cryptocurrency after Bitcoin, creates the NFTs. The average NFT generates 440 pounds of carbon—the equivalent of driving 500 miles in a gas-powered car—producing emissions 10 times higher than the average Ethereum transaction.

One digital artist estimated that the carbon footprint of an average NFT is equivalent to more than an EU resident’s electricity consumption for a month. Some artists, concerned about NFTs’ environmental impacts, are trying to raise awareness and look for more sustainable ways of creating them.

How can cryptocurrencies be more sustainable?

Because the entire Bitcoin network has invested millions of dollars in hardware and infrastructure, it would be difficult for it to transition to a more energy efficient system, especially since there is no central oversight body. However, there are a number of projects seeking to reduce the carbon footprint of Bitcoin and cryptocurrency in general.

Tesla CEO

Elon Musk met with the CEOs of top North American crypto mining companies about their energy use. The upshot was the creation of a new Bitcoin Mining Council to promote energy transparency.

The Crypto Climate Accord is another initiative, supported by 40 projects, with the goal of making blockchains run on 100 percent renewable energy by 2025 and having the entire cryptocurrency industry achieve net zero emissions by 2040. It aims to decarbonize blockchains through using more energy efficient validation methods, pushing for proof of work systems to be situated in areas with excess renewable energy that can be tapped, and encouraging the purchase of certificates to support renewable energy generators, much like carbon offsets support green projects.

Ethereum is aiming to reduce its energy use by 99.95 percent by 2022 through transitioning to an alternative validation system called proof of stake, as a few smaller cryptocurrencies have done. Proof of stake doesn’t require computational power to solve puzzles for the right to verify transactions. Rather it works like a lottery. To be considered, potential validators stake their Ethereum coins (ETH); the more they stake, the greater their chances of being selected randomly by the system to be the validator. Ethereum 2.0 will require participants to stake 32 ETH (each is worth about $3600 today) per validator opportunity, with multiples of 32 ETH for more chances. After a new block is accepted as accurate, validators will be rewarded with coins and keep the coins they staked.

The system ensures security because if validators cheat or accept false transactions in the block, they lose their stake and are banned from the network. When the price of ETH rises, stakes become more valuable, and thus network security increases, but the energy demands remain constant. Some worry, however, that proof of stake could give people with the most ETH more power, leading to a less decentralized system.

“Blockchain is a highly customizable and flexible technology,” said Farrokhnia. “You could design it in any shape or form that meets your objective. So, for example, another proof of consensus mechanism is called proof of reputation: the more reputable you are, the more votes you have in validating things.” The proof of authority system relies on reputation and trustworthiness; blocks and transactions are verified by pre-approved participants who must reveal their true identities. A few cryptocurrencies use proof of coverage that requires miners to provide a service—for example, hosting a router in their home to expand the network.

Other ideas for greening cryptocurrencies involve moving bitcoin operations next to oil fields where they tap waste methane gas that’s usually flared, pipe it to generators and use the power for bitcoin mining. Some bitcoin mining is planned for West Texas where wind power is abundant. Because there is sometimes more wind power than transmission lines can handle, bitcoin mining situated near

wind farms can use their excess energy.

Farrokhnia said that while these ideas are theoretically possible, they may not be pragmatic. “Each of these ideas requires very high upfront capital expenditures,” he said. “And we know that interest in mining is predicated on the price of bitcoin itself, so you could have all sorts of truly expensive solutions that would aim to be more energy efficient, but as soon as the price of bitcoin were to drop below a certain threshold, all these projects would be [cancelled] because they’re just not financially feasible. Who in reality would make those investments given the volatility in price of bitcoin and the uncertainty about the future of it?”

Farrokhnia’s hope for greener cryptocurrency lies in its evolution. He believes that cryptocurrencies cannot ignore environmental considerations if they want to gain wider adoption, and that newer and greener cryptocurrencies will eventually eclipse Bitcoin.

“There’s a new generation of crypto coming on board,” Farrokhnia said. “They are going to move away from proof of work for a number of reasons, one of which is the environmental impact, because most of these are being created by young programmers. They’re certainly more environmentally conscious, and hopefully, they understand the impact of the work beyond whatever they’re building and will take into account the complexity of today’s world.”

By Renee Cho

UNITED

NATIONS IPCC CODE RED -

The Intergovernmental Panel on Climate Change (IPCC) is the United Nations body for assessing the science related to climate change.

Having declared a Code Red, we wonder how that equated to the

Defense Readiness Condition, better known as the "Defcon"

warning system, in terms of war footing.

As of early 2017, the Earth

had warmed by roughly 2 degrees Fahrenheit (more than 1 degree

Celsius) since 1880, when records began at a global scale. The

number may sound low, but as an average over the surface of an

entire planet, it is actually high, which explains why much of

the world’s land ice is starting to melt and the oceans are

rising at an accelerating pace. If greenhouse gas emissions

continue unchecked, scientists say, the global warming could

ultimately exceed 8 degrees Fahrenheit, which would undermine

the planet’s capacity to support a large human population.

LINKS

& REFERENCE

https://www.smart-energy.com/industry-sectors/energy-efficiency/call-for-eu-ban-on-cryptomining/

https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

https://www.bbc.co.uk/news/business-56671488

https://www.smart-energy.com/industry-sectors/energy-efficiency/blockchain-energy-consumption-should-be-transparent-in-europe-call/

https://www.thisismoney.co.uk/money/investing/article-10222363/MR-MONEY-MAKER-Watch-tales-crypto.html

https://www.thisismoney.co.uk/money/investing/article-10222363/MR-MONEY-MAKER-Watch-tales-crypto.html

https://www.smart-energy.com/industry-sectors/energy-https://www.smart-energy.com/industry-sectors/energy-efficiency/blockchain-energy-consumption-should-be-transparent-in-europe-call/efficiency/call-for-eu-ban-on-cryptomining/

https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

https://www.bbc.co.uk/news/business-56671488

This

website is provided on a free basis as a public information service.

copyright © Climate Change Trust 2021. Solar

Studios, BN271RF, United Kingdom.

|