|

FUTURE SCIENCE NEWS 19 APRIL 2021 - Methanol fuel cells shown to provide higher efficiency than pure hydrogen

A new analysis shows that methanol fuel cells are more efficient at producing electricity than hydrogen fuel cells.

Fuel cells use hydrogen – the most abundant element in the universe – to produce clean and efficient electricity to power cars, trucks, buses and ships, as well as even homes and businesses. Hydrogen is considered the cleanest fuel of all, as burning it only produces water.

The same goes for the electrochemical process inside fuel cells, where hydrogen and oxygen are combined to form water, producing electricity in the process.

But hydrogen is also highly flammable. It has a lower ignition energy than gasoline or natural gas, which means it can ignite quite easily. As such, handling it can be quite dangerous, and developing means of doing so in a manner that’s safe for the average consumer has been one of the biggest challenges facing fuel cell technology.

Methanol is much more efficient than hydrogen alone

In their analysis, the Energy Industry Review outlines the many advantages of methanol as a hydrogen carrier. Not only is this alcohol less flammable than hydrogen, but it also packs more of hydrogen than even liquified hydrogen.

This means vehicles and establishments can run much longer using methanol than with an equivalent amount of liquified hydrogen alone, with less safety risks. (Related: Breakthrough on-demand hydrogen fuel generator may make hydrogen cars safe and practical.)

The analysis also points out that methanol can simply be “reformed” at an on-site fueling station to generate more hydrogen. In addition, fuel cell electric vehicles (FCEV) such as cars and buses can also use onboard reformer technology.

The latter means that FCEVs carrying methanol can travel longer ranges than those carrying pure liquified hydrogen alone – up to 800 kilometers (497 miles) on methanol compared to just 200 km (124 miles) on pure hydrogen alone.

In addition, the analysis points out that methanol can be produced much more economically than pure liquified hydrogen. The latter requires expensive and power-hungry electrolysis. At the same time, using renewable energy for hydrogen production – so as to not defeat the purpose of switching to hydrogen in the first place – was also expensive.

It took until 2019 for researchers to say that hydrogen produced through renewable means was “cost-competitive.” But even then, it was only for niche applications.

On the other hand, methanol can be cheaply produced from a wide range of conventional and renewable feedstocks. Because of this, the analysis calls methanol “the most affordable, sustainable, and easily handled hydrogen carrier fuel.”

Commercial FCEV using methanol-based hydrogen generator currently in testing

Developing a highly efficient and safe hydrogen infrastructure, whether or not it uses methanol as a carrier, is important as more companies start to develop fuel cell technology and FCEVs.

The analysis notes that hydrogen development company Element 1, in collaboration with Co-Win Hydrogen Power, announced the road testing of the world’s first medium-duty fuel cell last September. The test uses Element-1’s M-Series methanol-based hydrogen generator, incorporated into a medium-duty truck from a large truck manufacturer. Extended road testing of the vehicle is now currently under way in Asia.

“CO-WIN is both a valued strategic partner and licensee of e1, and we are excited to be working with them on this fuel cell truck project,” said Dave Edlund, Element 1’s Chief Executive Officer. “The hydrogen generation technology being deployed is unique to [Element 1] and is a game changer for clean transportation. To my knowledge, no other company in the world can provide a commercial onboard hydrogen generation product comparable to our M-Series product line.”

Other FCEV efforts, both as test programs and actual vehicles for sale or lease, have come before. Most notable are

Honda’s FCX Clarity and Toyota’s Mirai. But these have been limited releases targeted squarely at the passenger car market.

Element 1’s effort is one of the first to test hydrogen power on a commercial vehicle. Should it prove successful, the test could lead to greater use of hydrogen FCEVs using efficient, methanol-based systems in commercial applications.

“Our broad collaboration with CO-WIN is expected to result in the mass commercialization of fuel cell systems supporting not only transportation, but also telecom and distributed power applications throughout the Asian market,” he added.

https://energyindustryreview.com/methanol-fuel-cells-to-provide-higher-efficiency/

https://www.energy.gov/eere/fuelcells/safe-use-hydrogen

https://www.carbonbrief.org/renewable-hydrogen-already-cost-competative-say-researchers

Methanol is a fuel

that can be used in heat engines and fuel cells, hence is versatile in

application. Due to its high octane rating it can be used directly as a fuel in flex-fuel cars (including hybrid and plug-in hybrid vehicles) using existing

internal combustion engines

(ICE). Methanol can also be burned in some other kinds of engine or to provide heat as other liquid fuels are used.

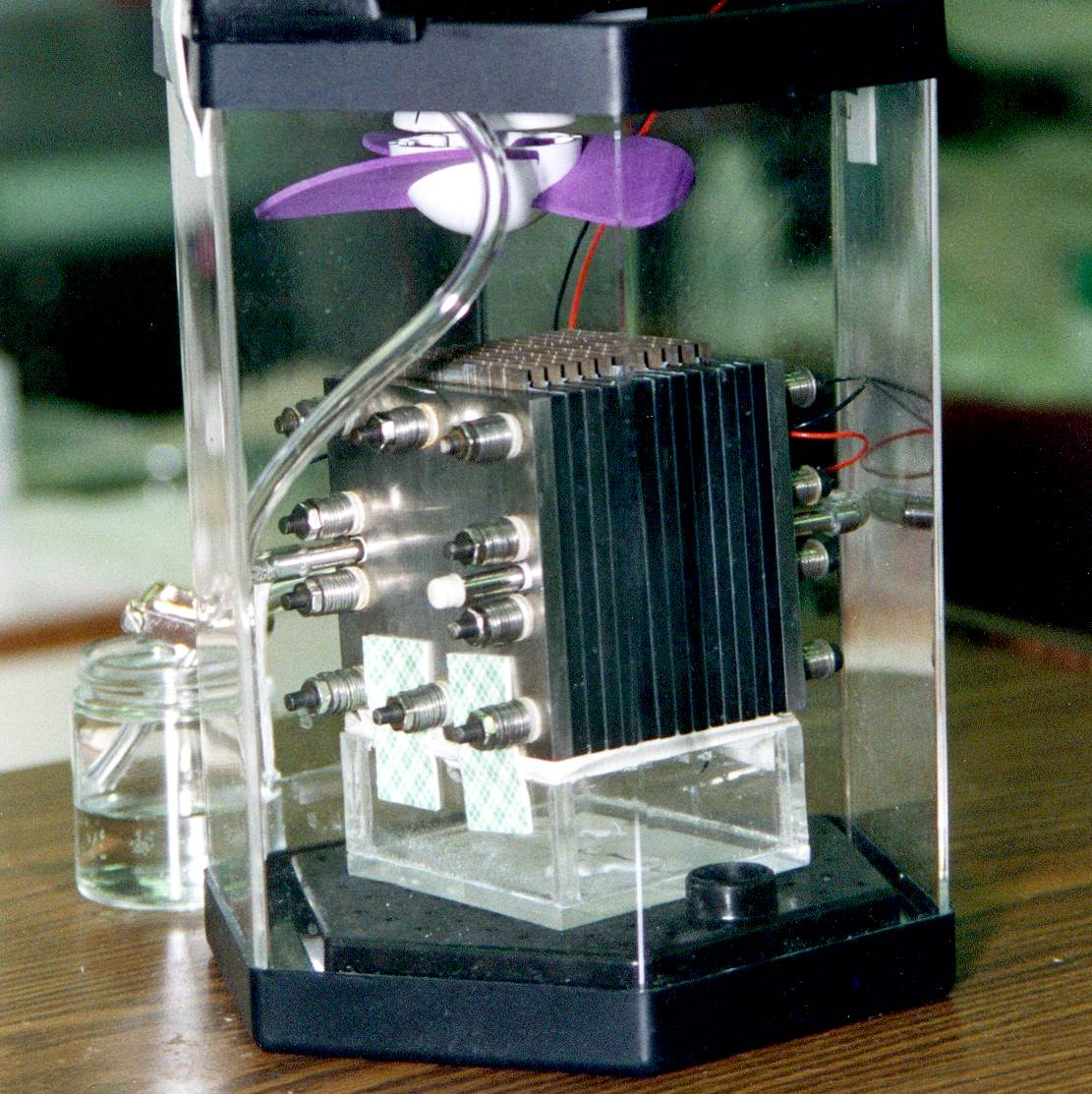

Fuel

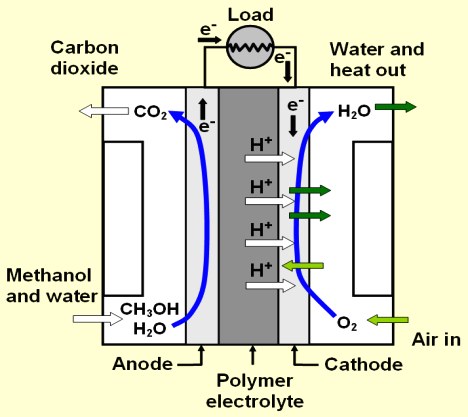

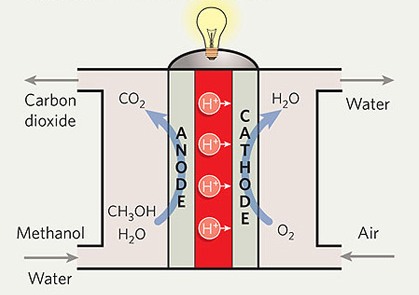

cells, can use methanol either directly in Direct Methanol Fuel Cells (DMFC) or indirectly (after conversion into hydrogen by reforming).

Direct-methanol fuel cells or DMFCs are a subcategory of proton-exchange fuel cells in which methanol is used as the fuel. Their main advantage is the ease of transport of methanol, an energy-dense yet reasonably stable liquid at all environmental conditions.

Efficiency is quite low for these cells, reaching around 10%, so they are targeted especially to portable applications, where energy and power density are more important than efficiency.

FOR

INTERNAL COMBUSTION ENGINES

Methanol is an nice replacement for gasoline and is used in mixed fuels, and it can also achieve a good level of performance in diesel engines. Its use in diesel engines requires an ignition enhancer, which may be a small amount of

diesel oil. In all tests performed, methanol shows good combustion properties and energy efficiency as well as low emissions from combustion.

A drawback of alcohol fuels such as

methanol is that energy contents are lower than for traditional fuels. Given equivalent

energy density, the space needed for storing methanol in a tank will be approximately twice that of traditional diesel fuels. Methanol and LNG are similar in terms of energy density.

BIG

CHALLENGES

-

Any way you look at it, the problems facing

the shipping industry have been magnified by the fact that there has been

little investment in anything other than big internal combustion engines.

NO

SULFUR

Regarding other emissions, sulfur is not present in methanol but may be released in small amounts in the upstream processes, depending on the energy carrier used for processing and transport. The emissions from the vessel are related to the sulfur content in the diesel quality fuels.

NOx emissions are low from the engines using methane and methanol because of a low combustion temperature and well-defined fuels. In order to make a fuel attractive for shipping, there has to be an adequate infrastructure that covers a large number of ports.

Bunkering of ships can be carried out by bunkering vessels as well as from land, and for both solutions there is a need for terminals that provide fuel. The infrastructure for methanol available today is based on the worldwide distribution of methanol to the chemical industry. This ensures widespread availability, although there may be a need for additional terminals for ship fuel. Within the SECAs, there are numerous terminals that serve the chemical industry.

For some ports in Europe, methanol is one of the leading chemicals in terms of volume handled. Currently, bunkering of methanol fueled ships is performed by truck. The trucks deliver the methanol to a bunkering facility with pumps built in containers on the quay next to the ferry. This is a solution that is flexible and easy to build. The technology and safety precautions build on long experience from methanol deliveries for other applications.

The methanol industry is global, with production in Asia, North and South America, Europe, Africa and the Middle East. The raw material is mainly natural gas for all producing countries except China, where the primary feed-stock is coal (Seuser, 2015). Global annual methanol production capacity exceeds 100 million tons. Methanol is used for many purposes, mainly in the chemical industry; fuel accounts for around nine million tons, mostly used as blend in gasoline. The global demand in 2014 was estimated at around 65–70 million tons, out of which at least 40 million tons were used in China (IHS, 2015). Methanol is available in all major shipping hubs globally. Several new plants are under construction.

FUTURE

ENGINE TECHNOLOGIES

Current methanol engines are all modified from dual-fuel engines intended for HFO, diesel and gas. A limited number of engines are suitable for retrofit. The converted engines are performing well but are not optimized for the purpose. The change to methanol fuel allows construction of more efficient and smaller engines. Several universities are developing new engine concepts for the combustion of methanol, and also other alcohols, in a diesel process. They include MIT, University of Ghent and Lund University of Technology.

The production cost of methanol is dependent on the raw material and production process. The processes that produce methanol via synthesis gas can be run with many raw materials, both fossil and renewable. For renewable raw material, a difference in production cost will arise from the upstream chain, that is, raw material

acquisition. Methanol is an attractive alternative from the point of view of fuel storage and bunkering infrastructure costs. Additionally, methanol is modular, allowing shipping companies to start with relatively modest investments and build up gradually as more ships convert to the fuel. As a fuel, methanol has been cost-competitive for the better part of the past five years but is currently at a disadvantage compared with low-sulfur marine gas oil.

The methanol institute has released a Methanol Safe Handling Manual for methanol distributors and users. This manual covers firefighting procedures for handling and preventing a methanol fire. When comparing methanol to gasoline for the interest of the automobile industry, methanol is considered safer. This is because methanol has a lower heat release rate than gasoline, it ejects less flammable fumes and methanol vapours are more easily dispersed to the atmosphere than gasoline. IMO is currently working on a regulatory framework that will cover the use of low flashpoint fuels on-board vessels.

The code will be called: The International Code of Safety for ships using gas or other low flash-point fuels (IGF Code). In 2013 the classification society Den Norske Veritas (DNV) released a new set of tentative regulations for marine vessels regarding low flashpoint fuels, which includes methanol. Methanol is difficult to ignite in an ordinary diesel engine. There are today two leading engine manufactures developing large marine engines compatible to run on methanol. The first one is Wartsila who are focused on developing four-stroke diesel cycle engines (Danbratt & Haraldson, 2013). The second company is MAN Diesel Turbo which is focused on remodelling their two-stroke diesel cycle engines to be methanol compatible.

The procedure of installing a methanol engine can be made through either building a new ship with a clean installation or as a conversion of the old engine. The conversion of the old engine is completed by replacing the cylinder head for a LGI type, adding the double walled piping, a new monitor system and installing a new ventilation system for the fuel pipes. This conversion is called retrofit and can be performed to all of the existing 2-stroke crosshead engines that MAN delivers. The retrofit will not affect the performance of the engine specification more than higher fuel consumption because of the lower heating value of methanol compared to diesel or HFO. Because methanol is a low flashpoint fuel there must be a ventilation system installed to prevent any leakage from entering the engine room atmosphere.

This ventilation system is combined with double walled piping which is installed to all piping within the engine room. If there is to be a leakage of the fuel from the primary pipe it will be leaking into the next pipe, the fuel fumes will be transported by the pipe ventilation to a gas detector. If any methanol fumes are detected the system will automatically shut of the methanol supply and switch over to full diesel operation. The price for constructing a new vessel with methanol fuelled engines is slightly higher than installing a regular diesel engine. This is mainly due to the costs for the double walled piping, inert gas system for tanks and the fuel delivery system. To retrofit a diesel powered vessel to run on methanol the cost will be about the same as installing the systems for methanol power for a new constructed ship at the shipyard.

When comparing investment costs for a methanol powered vessel and an LNG powered vessel the methanol vessel will be less

expensive. This is because a methanol vessel don’t need expensive high pressure fuel tanks and a very advanced fuel delivery

system. From an environmental point of view, methanol performs well. Methanol readily dissolves in water and is biodegraded rapidly, as most micro-organisms have the ability to oxidize methanol. In practice, this means that the environmental effects of a large spill would be much lower than from an equivalent oil spill.

Vs

Vs

S&P GLOBAL NOVEMBER 2019

London — As the shipping industry prepares for a wave of emissions regulation hitting it over the coming years, methanol suppliers are looking to take advantage of the situation to take a share of the 300 million mt/year global bunker market.

Shipping companies face a significant rise in costs when the International Maritime Organization's global 0.5% bunker sulfur cap comes into effect next year, with 0.5% sulfur bunker prices currently at a premium of about $230/mtto high sulfur fuel oil at Rotterdam. Delegates at the European Methanol Summit in Dusseldorf this week saw the upcoming changes for shipping as an opportunity for methanol to gain traction as an alternative bunker fuel.

"Methanol demand may grow at a reduced rate over the next two years because of the global slowdown," Hanna Sukhu-Maharaj, commercial manager of Trinidad-based methanol supplier MHTL, said at the conference. "But I think in the medium to long term, the substitution of conventional bunker fuels offers great potential for methanol."

Methanol produces negligible sulfur, nitrogen and particulate matter emissions when burned, and has reduced carbon dioxide emissions compared with conventional bunker fuels.

Methanol barge prices at Rotterdam have been $228/mt lower than 0.5% sulfur marine fuel barges over the past month. But given methanol's lower energy density, methanol prices by energy content worked out marginally higher, at $10.43/GJ for methanol versus $10.05/GJ for 0.5% sulfur bunkers.

Ships can be retrofitted to run on methanol; conference delegates estimated the conversion of the cruise

vessel Stena Germanica in 2015-16 was completed at a cost of a few million dollars. But shipping companies are also ordering new ships capable of running on methanol -- since 2016 Waterfront Shipping has been operating seven methanol-fueled tankers, and in 2018 in conjunction with MarInvest, NYK and Mitsui it agreed to charter four more.

MHTL's sister company Proman Shipping last month announced a joint venture with Sweden's Stena Bulk to jointly own and operate two new methanol carriers that are also methanol-fueled. The ships will each consume about 13,000 mt/year of methanol, MHTL's Sukhu-Maharaj said

Wednesday

Within the alternative bunker fuel market, methanol's main competitor at the moment is LNG, which has seen exponential growth as a marine fuel in recent years, albeit from a very low level.

S&P Global Platts Analytics forecasts LNG bunker demand may grow to as much as 15 million mt/year over the

next decade.

Delegates at the methanol conference stressed that both the delivery infrastructure and the alterations needed on board ships were much cheaper for methanol than for LNG. But they pointed out the much greater size of the LNG industry gave it more marketing and lobbying power to promote its use in shipping.

One supplier also said the current focus on scrubbers in shipping -- emissions-cleaning equipment that allows

a ship to continue burning dirtier fuels - was holding back the market for alternative bunker

fuels

"Scrubbers are killing this market for us," the supplier said.

Beyond 2020, the next challenge for the whole of the bunker market will be to determine what energy sources canbe used to comply with the IMO's initial strategy for the reduction of

greenhouse gases (GHGs). Last year, the IMO adopted a strategy of cutting carbon dioxide emissions per ship by at least 40% from 2008's levels by 2030, while cutting the shipping industry's total GHG emissions by at least 50% by 2050.

Using conventional methanol derived from natural gas as a bunker fuel, in conjunction with measures to maximizefuel efficiency, may be enough to meet the 2030 target, but will be insufficient for the IMO's 2050 goals.

But renewable methanol, derived from biomass or carbon dioxide combined with hydrogen, could be an energy source with low enough net GHG emissions. This would be likely to be much more expensive than conventional bunker fuels, but that would also be the case for any solution in line with the IMO's 2050 strategy.

Remko Detz, a scientist in the energy transitional studies unit of Dutch research organization TNO, said pricesfor renewable methanol should come down sharply towards 2050, and could be competitive with conventional methanol by2035 or before. This estimate is based on significant additions in renewable power capacity worldwide, as electricity is needed to create the hydrogen needed to make the fuel.

The fight to become the dominant low-GHG marine fuel is likely to become increasingly heated over the next decade, with aggressive lobbying from all sides. But as the methanol market worldwide is currently just around 100 million mt/year, taking only a small share of bunker supply would amount to a large boost to demand.

by Jack Jordan, jack.jordan@spglobal.com

Edited by James Leech, james.leech@spglobal.com

THE METHANOL ECONOMY

The methanol economy is a suggested future economy in which methanol and dimethyl ether replace fossil fuels as a means of energy storage, ground transportation fuel, and raw material for synthetic hydrocarbons and their products. It offers an alternative to the proposed hydrogen economy or ethanol economy.

In the 1990s, Nobel prize winner George A. Olah advocated a methanol economy; in 2006, he and two co-authors, G. K. Surya Prakash and Alain Goeppert, published a summary of the state of fossil fuel and alternative energy sources, including their availability and limitations, before suggesting a methanol economy.

Methanol can be produced from a wide variety of sources including still-abundant

fossil fuels (natural gas, coal, oil shale, tar sands, etc.) as well as agricultural products and municipal waste, wood and varied biomass. It can also be made from chemical recycling of carbon dioxide.

LINKS

& REFERENCES

https://www.sfc.com/en/technology/direct-methanol/

https://energyindustryreview.com/analysis/fighting-against-air-pollution-methanol-fuel-cells-to-provide-higher-efficiency/

https://www.energy.gov/eere/fuelcells/safe-use-hydrogen

https://www.carbonbrief.org/renewable-hydrogen-already-cost-competative-say-researchers

https://futuresciencenews.com/2021-04-19-methanol-fuel-cells-higher-efficiency-hydrogen.html

https://www.methanol.org/fuel-cells/

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/111419-feature-methanol-industry-seeks-slice-of-bunker-demand-on-emission-cuts

http://livebunkers.com/methanol-marine-fuel

https://shipandbunker.com/news/world/787285-methanol-bunkers-good-for-imo-2020-and-gives-shipping-a-pathway-to-zero-carbon-fuel-report

http://www.blue-growth.org

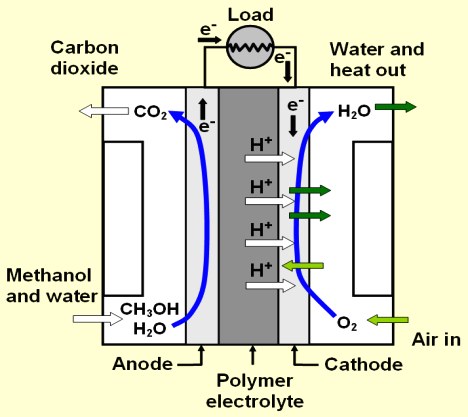

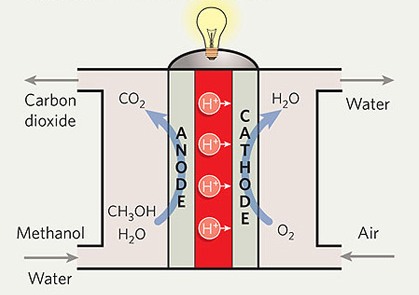

DIRECT

-

This diagram shows how a methanol fuel cell

works.

Please use our A-Z

INDEX to navigate this site

AMMONIA

- COMPRESSED

GAS - ECONOMY - FUEL

CELLS - FUSION

- HYDRIDES

- LIQUID GAS

- METHANOL

|