USA

- In 2003, President Bush announced a program called the Hydrogen Fuel Initiative

(HFI) during his State of the Union Address. This initiative, supported by legislation in the Energy Policy Act of 2005 (EPACT 2005) and the Advanced Energy Initiative of 2006, aims to develop hydrogen, fuel cell and

infrastructure technologies to make fuel-cell vehicles practical and cost-effective by 2020.

Obviously, the legislation did not work, or we'd seen hydrogen

cars selling like hot cakes. Whereas, there are significant

sales of battery electric cars.

The

United States has dedicated more than

two billion

dollars to fuel cell research and development so

far. Yet the basics principles of climate change is to

find the best way to use less energy to achieve the same goal.

Of course we have to explore all avenues before deciding on

what works best. Thomas

Edison found 1,000 ways not to make a light bulb before

inventing his carbon filament version that succeeded. Joseph

Swan in the UK filed a similar patent before the more famous

US inventor.

The

allure of the hydrogen economy is plain, splitting plain ordinary water

using electrolysis to obtain oxygen

and hydrogen gas is

like a dream come true, especially if we can generate free electricity using

solar cells and wind turbines to split the water. Then the hydrogen is free

right. But

is the electricity free?

No, not really.

There

is a cost, including the cost of manufacturing the solar panels or

wind

turbines.

Where

there is a cost, then we have to consider payback time and working life. If

we can use most of the solar and wind

energy directly to power vehicles, we make the best

of the working life of our energy harvesting apparatus. And that means

reduced greenhouse gases, so a reduced carbon footprint

for the human race in an anthropogenic

fight against

climate change.

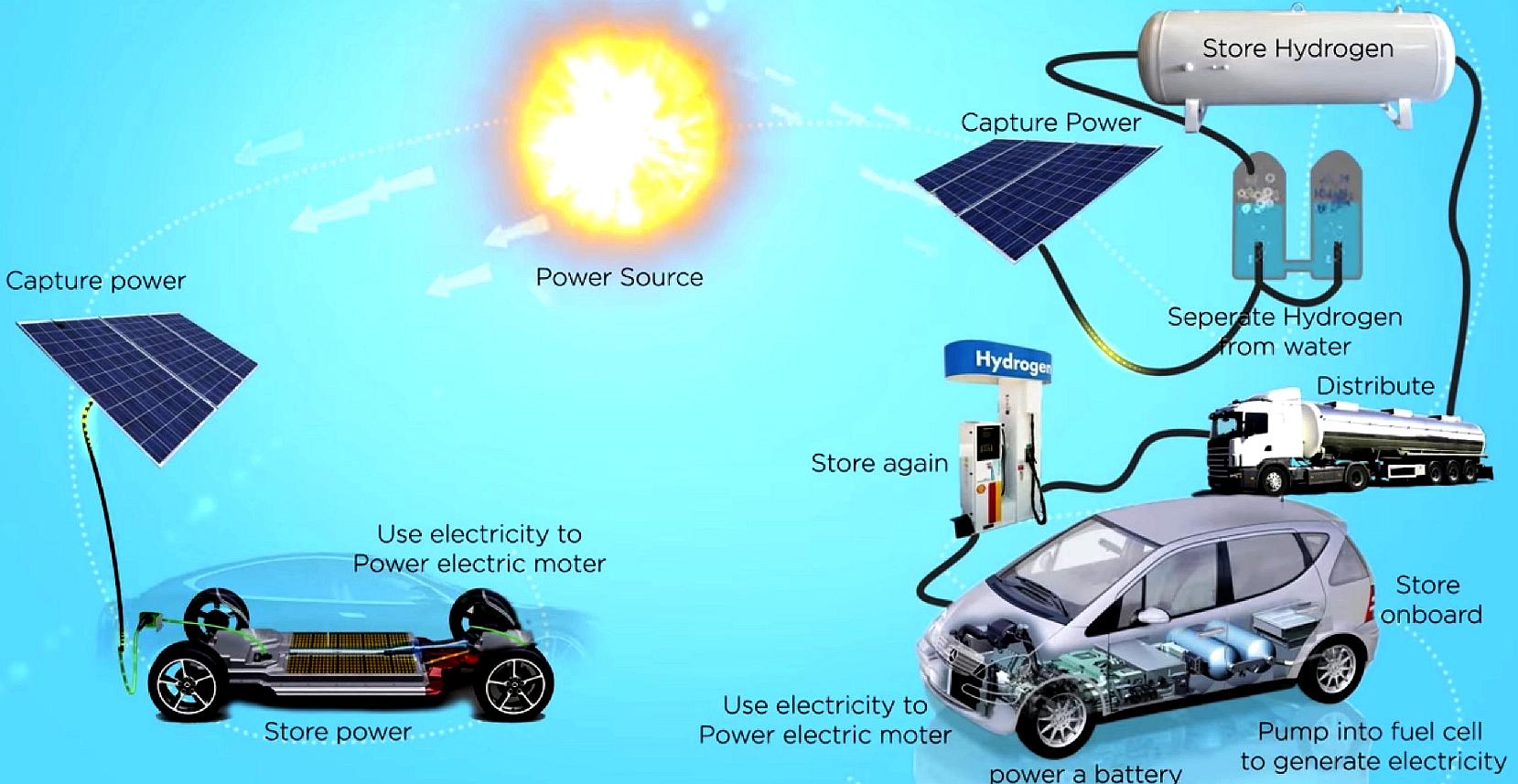

AUTOMOTIVE

EV COMPARISON

-

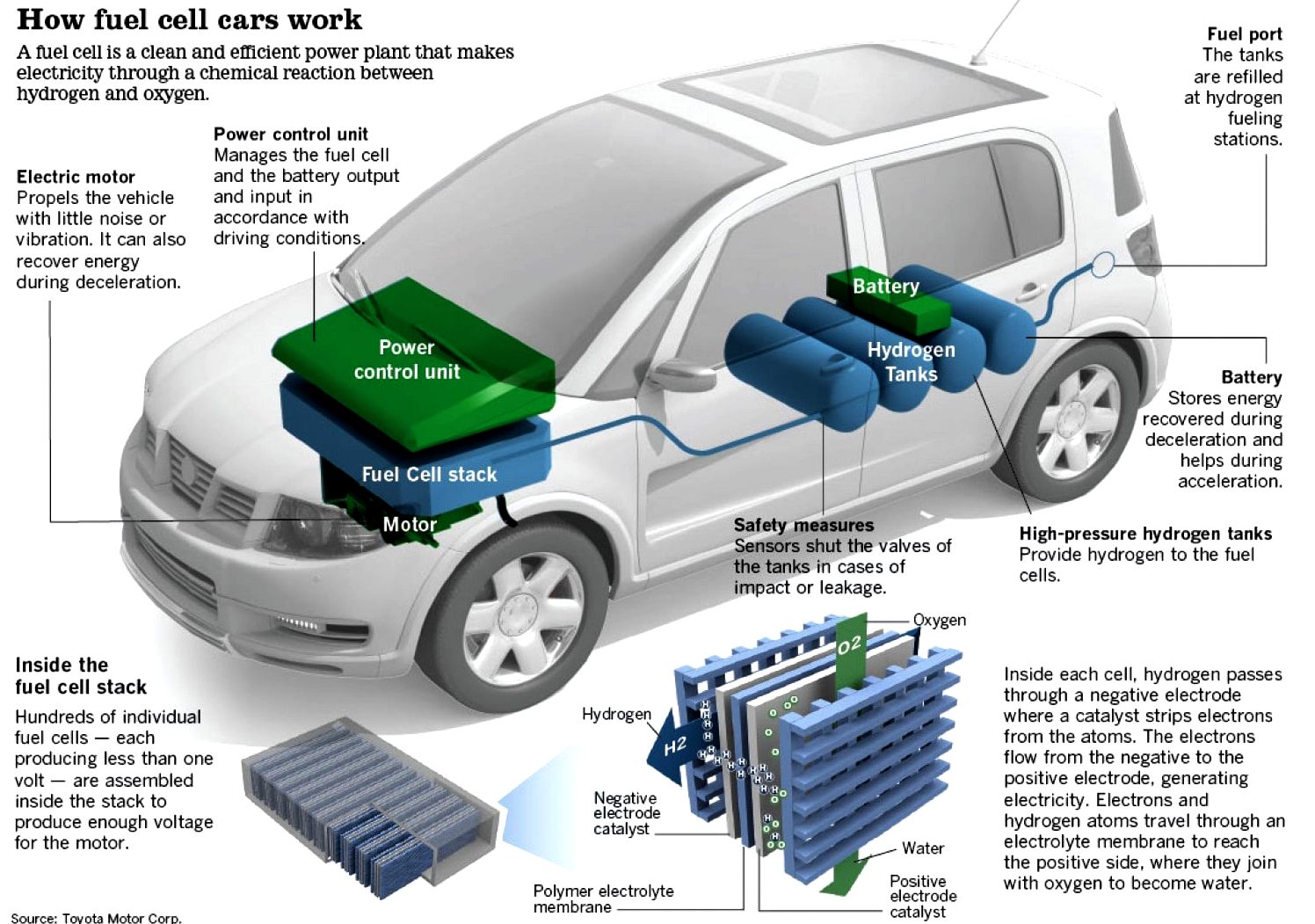

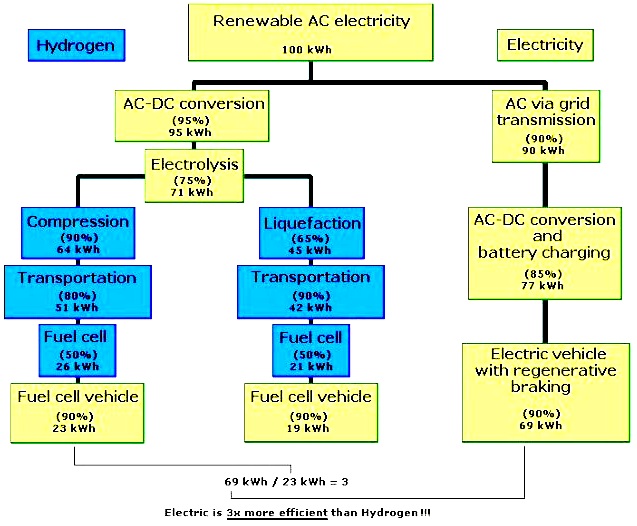

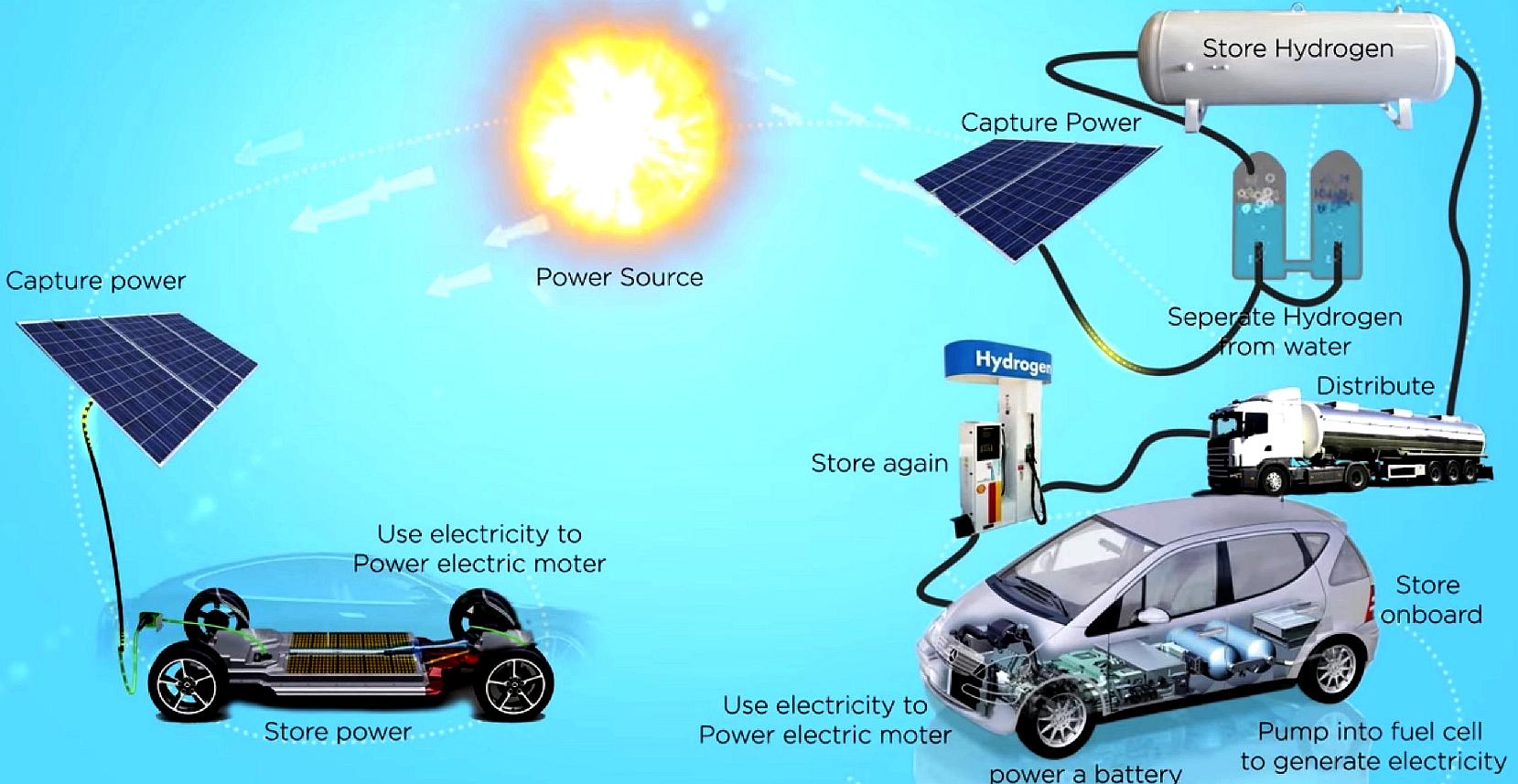

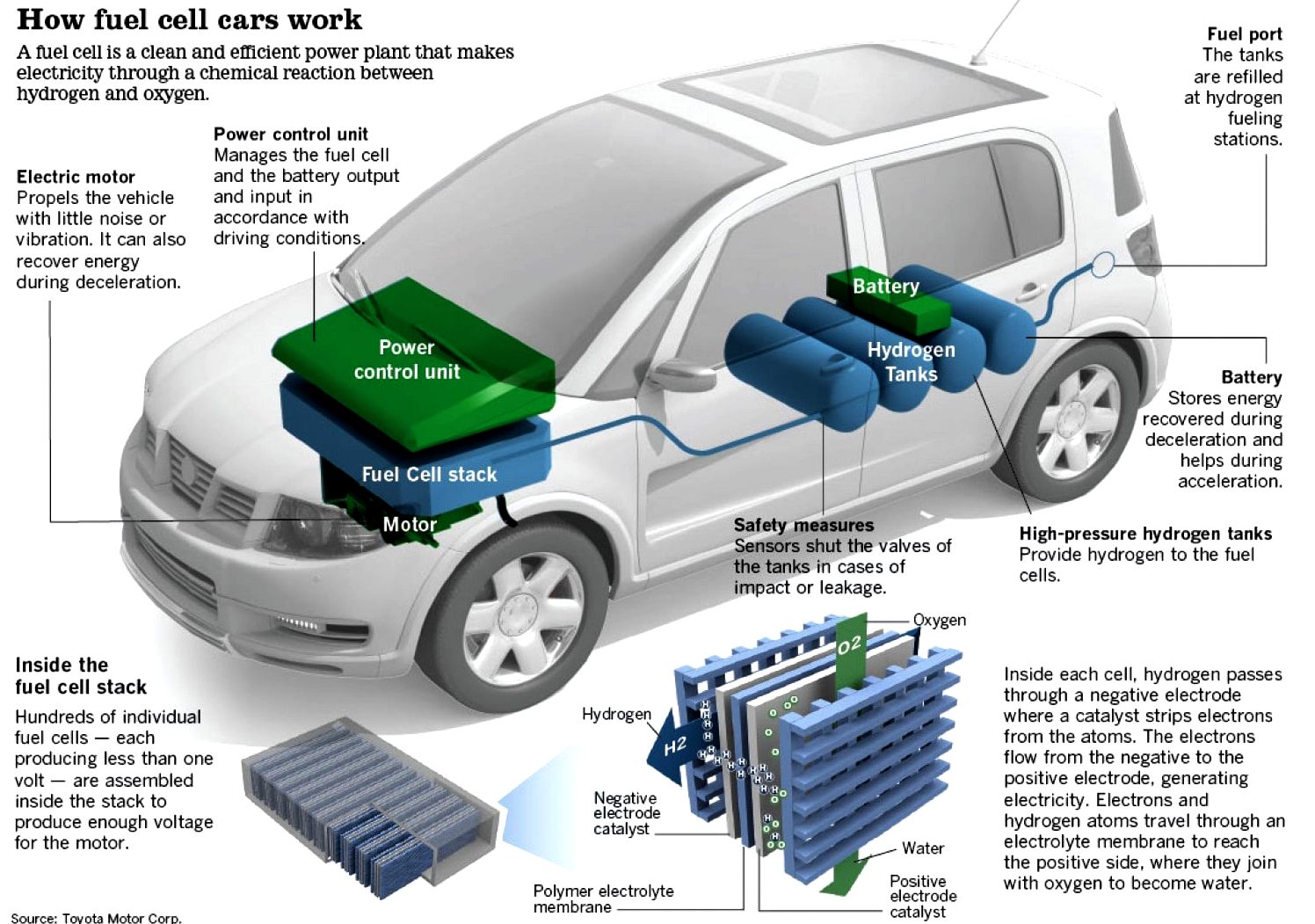

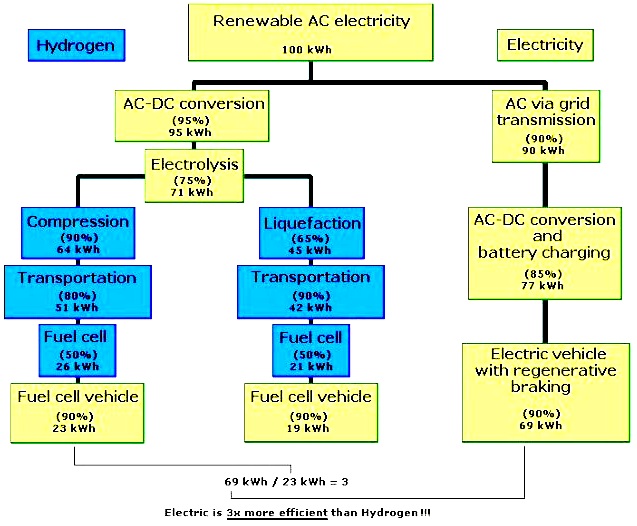

This diagram relating to electric cars

illustrates the additional complication, hence conversion inefficiencies, of

going the hydrogen route. You'd need more solar panels and more wind

turbines to power fleets of cars and ships if hydrogen fuel cells were used.

Another problem is that hydrogen is difficult to store for long periods because

it has extremely tiny molecules that easily leak out of most

containers - and since hydrogen is flammable, leaks can cause horrific explosions.

WHAT

ABOUT HYDROGEN CARS?

According

to an article in the Financial

Times (October 2017), Honda and Toyota think fuel cell technology’s superior energy density will triumph over

batteries.

Japan wants the Tokyo Olympics of 2020 to run on hydrogen. Planners envisage fleets of hydrogen-fuelled cars whisking athletes from the village to the venues. They are even pondering the practicalities of a hydrogen-burning Olympic flame to promote one of Japan Inc’s boldest gambles: that hydrogen, not

batteries, will become the automotive power source of the future.

Toyota and Honda both have fuel-cell vehicles on the road, betting that despite the greater complexity and cost of the

hydrogen technology, its superior energy density compared with

batteries will ultimately give it a decisive advantage in range.

SMARTNET

FASTCHARGE - This (proposed) design for a Universal EV service station

works with batteries and hydrogen fuel cell (or Universal)

cartridges, in liquid, gas and hydride form. President Bush may get his wish,

provided that laws are in place to push for a transport

infrastructure for EVs along the lines of the UK's Automated

and Electric Vehicles Act 2018, which is at the moment (Feb 2020) pathetically

lacking. Other G20

countries do not even have such statutory requirement.

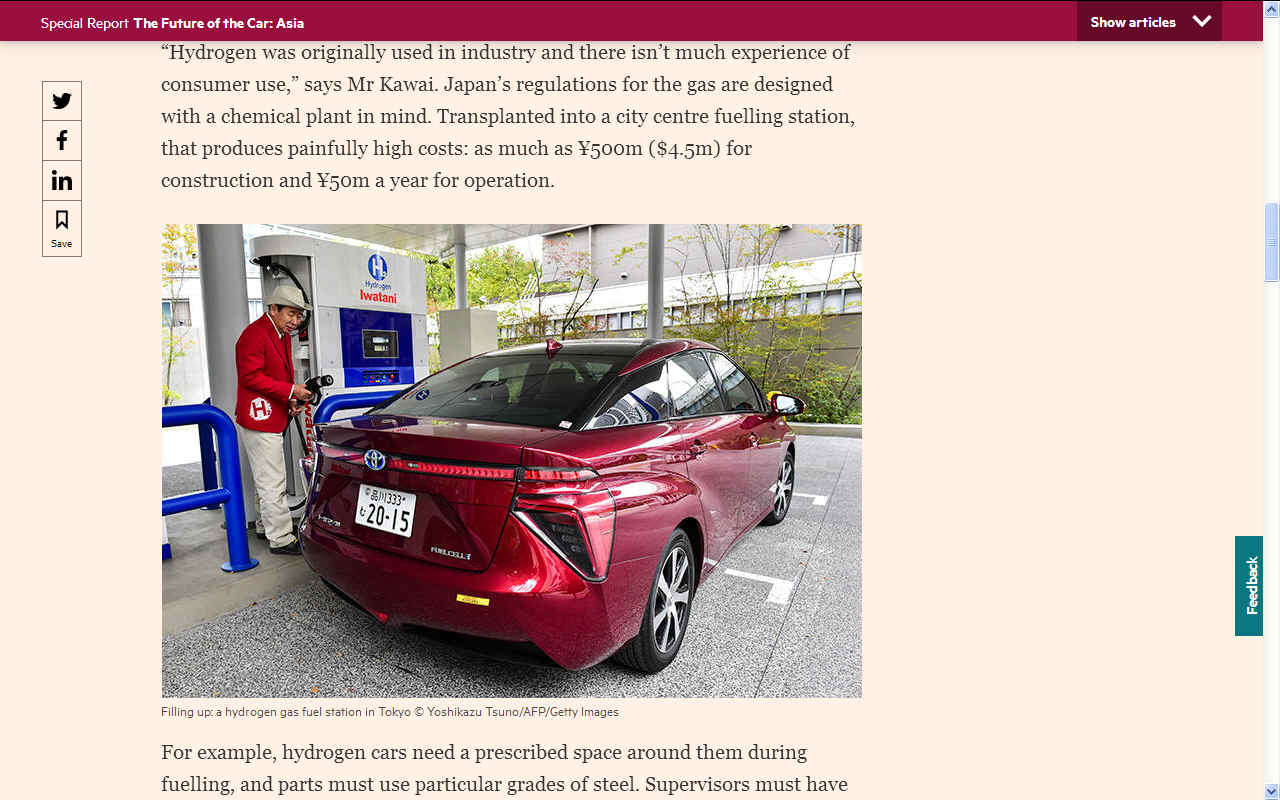

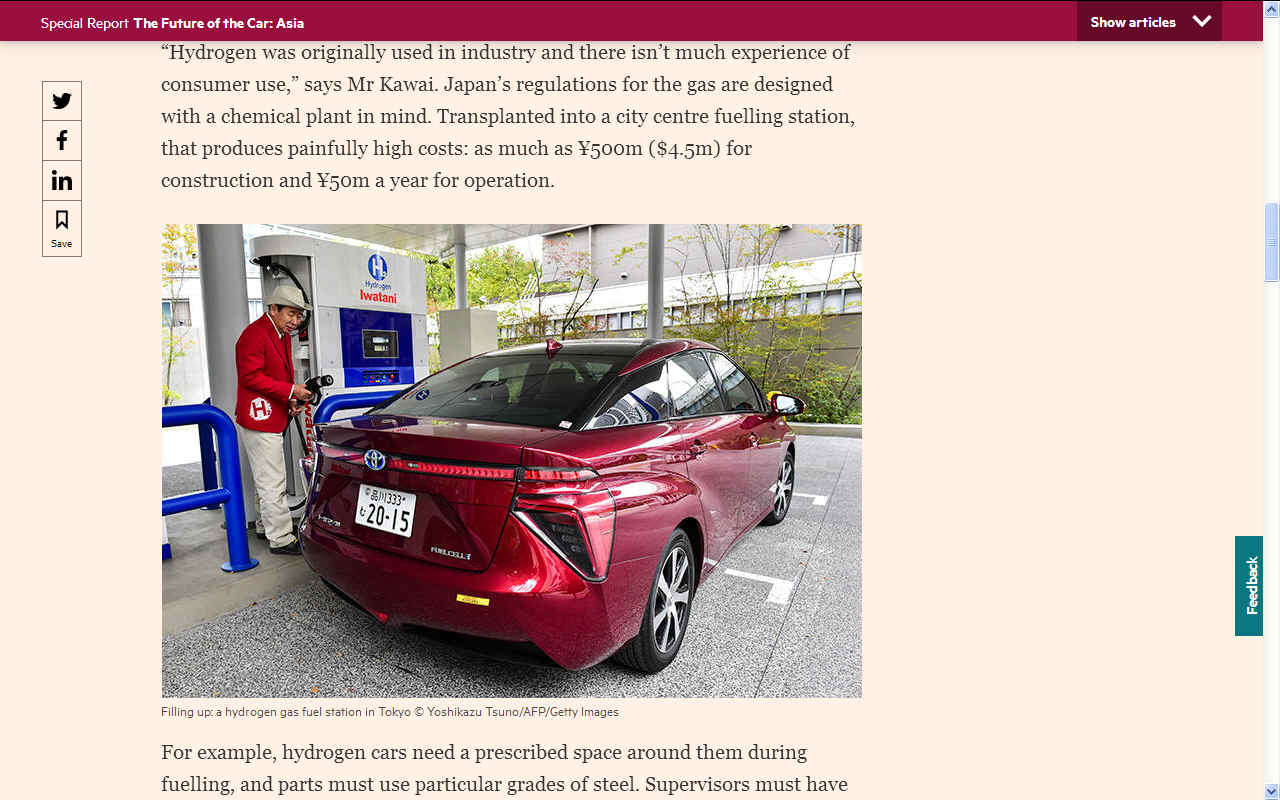

Efforts to boost sales of hydrogen cars have hit an unexpected obstacle, however: stringent Japanese regulations that make it cripplingly expensive to build a

hydrogen filling

station. Fuel-cell cars are no good without somewhere to fill them up, so Japan is engaged in a drastic rewrite of the rules.

“There’s an issue because Japan’s severe regulations push up the construction cost and running cost of a hydrogen station,” says Taiyo Kawai, project general manager at Toyota’s R&D and engineering management division, who has spent a decade working on hydrogen cars. A fuelling station in Japan may cost two or three times the price in

Europe.

“Hydrogen was originally used in industry and there isn’t much experience of consumer use,” says Mr Kawai. Japan’s regulations for the gas are designed with a chemical plant in mind. Transplanted into a city centre fuelling station, that produces painfully high costs: as much as ¥500m ($4.5m) for construction and ¥50m a year for operation.

For example, hydrogen cars need a prescribed space around them during fuelling, and parts must use particular grades of

steel. Supervisors must have experience of handling hydrogen and other high-pressure gases. Records must be kept of who handles and purchases the fuel. It is a long way from a self-service gasoline stand.

The issue with regulation highlights one of the biggest challenges for hydrogen versus batteries. Whereas the latter can use existing electricity wires, hydrogen needs its own infrastructure. No one wants a fuel-cell car without a

fuelling

infrastructure, and no one wants to pay for the infrastructure until there are cars to use it.

Refuelling a hydrogen car in Japan is indeed an oddly luxurious experience. An enormous expanse of concrete surrounds your new

Toyota Mirai or

Honda

Clarity. All equipment is machined to the highest grades. A smartly clad attendant will rush out of the office to top up your tank with the ultra-light gas.

All the rules add to what hydrogen proponents regard as a damaging perception that the fuel is dangerous, imprinted on the public mind by the

Hindenburg airship disaster of 1937, where a hydrogen-fuelled zeppelin crashed and burnt with the loss of 36 lives. Hydrogen is highly flammable but, unlike

gasoline, the ultralight gas quickly disperses rather than pooling and burning.

Prime Minister Shinzo Abe has made rewriting the rules a national priority. “To meet our goal of 40,000 fuel-cell vehicles on the road by 2020 we need a plan to accelerate the rollout of hydrogen fuelling stations,” he said in April. “In order to rationalise the regulation on hydrogen stations, please look at this in general, bearing in mind the rules overseas and the comparison with domestic gas stands.”

A pan-government plan for deregulation, published in June, includes dozens of items designed to roll back rules on

hydrogen filling stations. Many are meant to take effect next year or in 2019, although that may be too late for the

Olympics. Japan’s goal is to increase the number of refuelling stations from about 80 in 2016 to 160 by 2020 and 900 by 2030. Each refuelling station will need to service about 900 vehicles a year to remain profitable and the target is to reach that level by 2030.

Government subsidies are expected to expire by about 2020, so energy companies may need to operate money-losing

refuelling stations for about a decade before there is a self-sustaining number of fuel-cell vehicles.

Getting there will also require reductions in the cost of a fuel-cell vehicle. The Toyota Mirai retails for $57,500 in the US. Bringing that price down will require larger-scale manufacturing as well as progress on the fuel cell, which uses expensive materials such as platinum.

The ability to reduce costs is likely to be constrained, however, by the complexity of the technology. A hydrogen vehicle has similarities with a gasoline-electric hybrid, combining a gasoline engine and an electric motor, only with a fuel cell replacing the

internal combustion

engine.

The trump card is range. Toyota claims a 312-mile driving range for the Mirai and there is scope to add to that by increasing the pressure at which hydrogen is stored in the vehicle’s tanks.

“We see fuel-cell vehicles as the ultimate eco-car,” Kiyotaka Ise, Toyota’s head of advanced R&D, told the Financial Times in an interview last year. “Everyone is saying electric vehicles [are the future] but there is still a long way to go. EVs are far easier to make than FCVs. Toyota is putting huge effort into fuel-cell vehicles.”

By Richard Harding in Tokyo

SCOTTISH

FERRIES

-

Caledonian Maritime Assets Ltd (CMAL) is one of several industry partners to be involved in a feasibility study carried out by Point and Sandwick Trust. The study assesses the suitability of using hydrogen produced from local wind farms to power future ferry services operating in the Western Isles and West Coast of Scotland. The study was part-funded by the Scottish Government’s Low Carbon Infrastructure Transition Programme.

According

to CNBC article dated February 26 2019, Toyota is helping Japan with its multibillion-dollar push to create a hydrogen-fueled society.

Key Points

- With only a fraction of its nuclear sector operational, Japan has set its sights on hydrogen to fuel its economy and end dependence on foreign oil and gas imports.

- Toyota is trying to spark change. It is partnering with the

Dutch Institute for Fundamental

Energy Research to develop a device that uses sunlight to produce hydrogen from humid air.

- The automaker unveiled a prototype of a hydrogen-fuel cell truck with Paccar at the CES show.

- Toyota and Honda are selling hydrogen-powered cars and have teamed up to sharply increase hydrogen refueling stations across the country.

- By 2050, Toyota aims to cut global average

carbon dioxide emissions from its new vehicles by at least 90 percent compared to 2010

Earlier this month, Toyota announced a research project that could help make hydrogen an energy game changer. In partnership with the Dutch

Institute for Fundamental Energy Research, Toyota Motor Europe is developing a device that uses sunlight to produce hydrogen from humid air. If improved and scaled up, the solid-state photoelectrochemical cell might eventually power homes or cars.

It’s one of the many promising technologies surrounding hydrogen, an energy source proponents say could help reduce our dependence on polluting fossil fuels. While dirty energy has been used to make hydrogen, the Toyota project, which has a grant from the Netherlands Organization for Scientific Research, would only use sunlight and air.

The research project reflects the Japanese conglomerate’s renewed push into hydrogen. At last month’s Consumer Electronics Show in Las Vegas, Toyota and truck maker Paccar showed off a hydrogen-powered fuel cell truck, the first of a series of prototypes that could help cut pollution at container terminals. But these initiatives are part of a larger effort to realize the clean-energy dreams of Japan itself.

It’s easy to see why. Japan is the world’s largest importer of liquefied natural gas (LNG) and among the top four coal and oil importers. It used to generate about 30 percent of its power from nuclear reactors before the Fukushima disaster in 2011 when a magnitude-9 earthquake and tsunami caused meltdowns, forcing the country to temporarily put all reactors offline. That accelerated Japan’s push toward sustainable energy. Its goal: to build a hydrogen-based society and show off progress in 2020, when Tokyo hosts the Summer Olympics.

Just as the 1964 Tokyo Olympics left a legacy of widely used bullet trains, the 2020 Games would bequeath hydrogen infrastructure for future generations, former Gov. Yōichi Masuzoe declared. On a national level, the ambitious Strategic Energy Plan — that includes a 30-year road map on measures for manufacturing, transportation and storage — may serve as a model for other countries.

Major hurdles to overcome

But the shift has been challenging since it kicked off in 2014. Hydrogen must be produced, it can be difficult to transport and store, and fuel cells remain expensive and relatively inefficient. In 2016, Japan’s Ministry of Economy, Trade and Industry (METI), decided that by 2020 there would be some 40,000 hydrogen fuel-cell vehicles (FCEVs) on Japan’s roads, along with 160 fueling stations and 1.4 million residential fuel cells, known as Ene-Farms. METI is expected to spend at least 108 billion yen (US$975 million) on hydrogen projects over a two-year period ending March 2020.

Yet with less than a year and a half to go before the Olympics opening ceremony, a hydrogen society seems a distant dream. Evidence of hydrogen power in everyday use is scant: Tokyo is supposed to have a fleet of more than 100 Toyota hydrogen fuel cell public buses operating by the Games, but only about seven are in service, shuttling between Tokyo Station and Tokyo Big Sight, a venue for meetings and tradeshows; a fueling station issue had halted the entire fleet in mid-February.

While there could be about 120 fueling stations in Japan by next year, construction costs are about triple those of gasoline stands and demand remains limited, especially outside big cities. In southern Japan’s Saga Prefecture, for instance, there are only about 16 fuel cell vehicles and the only hydrogen station, built in 2016, sees only one customer per day, according to the Saga Shimbun newspaper. Fewer than 3,000 FCVs have been sold in Japan so far, according to Next Generation Vehicle Promotion Center, a Tokyo think tank, and cumulative sales are likely to be far short of the 40,000 goal for 2020. As for residential cells, cumulative sales only crossed the 250,000 threshold in July 2018, according to

Bloomberg NEF.

AUTOMOTIVE

EV COMPARISON

-

Where charging up a battery-powered car can take anything from half an hour to a whole night, you can refuel a hydrogen car in just five

minutes - as quickly as you can fill the gas tank of an ordinary car. Fuel-cells are better for larger vehicles like trucks, but there are trucks with batteries. Some of these things may change with time as the two rival

technologies - hydrogen fuel cells and rechargeable batteries - develop and mature.

For example a battery cartridge exchange system was invented in the UK in

the 1990s where exchanges took just 80 seconds. That time could be reduced

to 30 seconds with modern technology- and in this system the car had built

in loaders, meaning that the car could recharge itself without expensive

service stations so long as batteries were laid out for collection on flat

concrete forecourts. A recharging service station would complete the system

- also on the drawing board, but nobody cared enough about climate change to

fund development. In those days the British Dti was also pushing for

hydrogen cars.

PRIVATE

SECTOR PUSH

The country will likely fail to meet its goals, but it isn’t putting the brakes on hydrogen. If anything, it’s ramping up thanks to the private sector.

* In March 2018 a group of 11 Japanese companies, including Toyota,

Nissan and Honda, launched a venture called Japan H2 Mobility (JHyM) to build 80 hydrogen fueling stations by 2022. The company says it has nearly completed 12 stations.

* The following month, Kawasaki Heavy Industries and other companies announced a project to extract hydrogen from brown

coal in Australia and liquefy and ship it to Japan in massive quantities in a bid to lower costs.

* Another group, including oil and gas company Chiyoda, is planning to kick-start what it calls the first-ever international hydrogen supply route by importing up to 210 tons of hydrogen, enough to fill 40,000 FCVs, from Brunei in a demonstration next year.

* Last year Tokyu Hotels opened what it describes as the world’s first hotel powered in part by hydrogen derived from waste

plastic. Nicknamed The Warehouse, Kawasaki King Skyfront Tokyu REI Hotel has a fuel cell generating CO2-free electricity and hot water used in guest rooms, according to Toshiba Energy Systems & Solutions, which has provided similar cells to swimming pools and convenience stores.

Japan is also trying to increase domestic hydrogen production. It stood at an estimated 200 tons in April 2018, and by improving production technology and establishing regular hydrogen imports, the government wants to increase it to 4,000 tons in 2020 and 300,000 tons in 2030, according to METI’s Hydrogen Basic Strategy.

Some projects are under way to boost output. For example, a consortium including Toshiba Energy Systems & Solutions and the New Energy and Industrial Technology Development Organization (NEDO), a state-backed R&D center, began construction of a facility in Fukushima last year that will produce up to 900 tons of hydrogen annually using wind and solar energy sources as well as grid electrical power. The hydrogen will be used to power FCVs and factories in northern Japan and elsewhere. Tokyo Gov. Yuriko Koike said it will also be used to run the athletes’ village during the 2020 Games. In 2018, NEDO said a project it launched with Kawasaki Heavy Industries and construction firm Obayashi achieved the world’s first supply of heat and

electricity in an urban area using hydrogen alone as fuel. The goal is long-term development of a new energy supply method for communities.

“Energy transition will take a long time, and even in 2030 only 800,000 FCVs will be installed,” said Eiji Ohira, a director at NEDO. “We are working on hydrogen with a view toward 2050. There are many challenges such as cost reduction, improving technology for hydrogen production, storage, transport and utilization.

Japan will take a leadership in this field based on our experience in promoting hydrogen. Also, we are going to collaborate with other countries to realize a hydrogen-based society.”

Toyota leads the way

Of all corporate Japan’s hydrogen cheerleaders, Toyota Motor stands out for its commitment to FCVs. The Prius maker has been researching fuel cell technology for more than 25 years, with its first concept FCV making its debut in a parade in Osaka in 1996. In recent years, Toyota has been boosting investment in hydrogen

fuel cell vehicles, designing lower-cost, mass market passenger cars and SUVs and pushing the technology into buses and trucks to build economies of scale.

By 2050, Toyota aims to cut global average CO2 emissions from its new vehicles by at least 90 percent compared to 2010. In December 2014, Toyota launched the world’s first production FCV with the Mirai, a futuristic-looking sedan that has a range of 500 kilometers per tank. But its expensive fuel cell stack means the Mirai carries a hefty price tag of some $60,000 before incentives, one of several factors that have limited sales.

As of the end of 2018, more than 7,500 units had been sold in about 16 countries, according to the automaker. It’s now trying to shift to mass production ahead of the next-generation Mirai. Aside from hydrogen-powered semis and buses, Toyota has been expanding use of fuel cell forklifts at its Motomachi car plant in Toyota City and deploying them at the Port of Los Angeles. In 2018, it announced moves to expand production of fuel cell stacks and hydrogen tanks ten-fold after 2020, as well as plans to work with Seven-Eleven Japan to deploy small fuel cell delivery trucks. It hopes to sell more than 30,000 FCVs annually, but it sees FCVs as only one part of a mix including other forms of electric vehicles.

“For us, it is not a matter of trying to achieve [long-term hydrogen use] — we believe we must achieve this,” said Hisashi Nakai of Toyota’s Corporate & Technology Group. “Reducing the amount of CO2 emissions is an important issue and must gradually shift to emitting less CO2 as part of our energy consumption. Hydrogen is easier to store and transport when compared to electricity, and because it is simple to convert from electricity, it can address the challenges usually attributed to the conversion, transmission and distribution of electricity. We think that the use and application of hydrogen as an energy source is what we should be doing, so we are making efforts to help spread the use of FCEVs.”

What lies ahead

Some experts think Japan has to concentrate more on the fundamentals of its hydrogen dream. Japan holds about 60 percent of worldwide fuel cell patents and invested nearly $15 billion on renewables, hydrogen and fuel cells from 1974 to 2015, according to Noriko Behling, co-author of a 2015 article on hydrogen in Japan in the Elsevier Economic Analysis and Policy Journal. But fuel cells need to be cheaper, more durable and efficient to spark real change.

“There is a fundamental need for greater investment in R&D with respect to hydrogen and fuel cell technologies, yet

Japan’s government is cutting R&D,” said Behling, pointing to decreasing government outlays.

Martin Tengler, an energy analyst at BloombergNEF in Tokyo, said many researchers are working on improved fuel cell designs and more efficient storage options, such as metal hydrides, but it’s unknown whether these will reach commercialization. Cost and the participation of other countries will be the overriding factors in the viability Japan’s hydrogen utopia.

“It’s too early to tell how viable an energy source hydrogen could be for Japan,” said Tengler. “Current estimates put the cost of importing hydrogen in 2025 at over twice the current price of imported LNG, but it’s early days for the technology. If it follows the rapid cost reduction path that solar and wind technologies have, then costs could fall much faster than is currently expected.”

By Tim Hornyak

....

WHAT

ABOUT HYDROGEN SHIPS ?

Like

cars (at the moment), hydrogen ships are not

that green. The message doesn’t seem to have broken through to many people in the “green” and “cleantech”

community who are pushing new innovation development - in a

race against the clock.

WHY

IS THAT ?

Well, Hydrogen Fuel Cell (HFC) vehicles are perceived to be a good bridge between fossil fuels and full electric because:

- You can still fill up like you do with a diesel

bunkered ship.

- The mileage you can get out of hydrogen is perceived to be more adequate than

you

might achieve from batteries.

- Hydrogen fuel cells are thought

to last longer than batteries (or conversely, batteries are thought to

have a shorter life).

- Hydrogen as a fuel is perceived to

offer relatively small infrastructural changes from

fossil fuels.

- Hydrogen is perceived as a cleaner solution

than diesel or natural gas or LPG.

THE

TERMINATOR

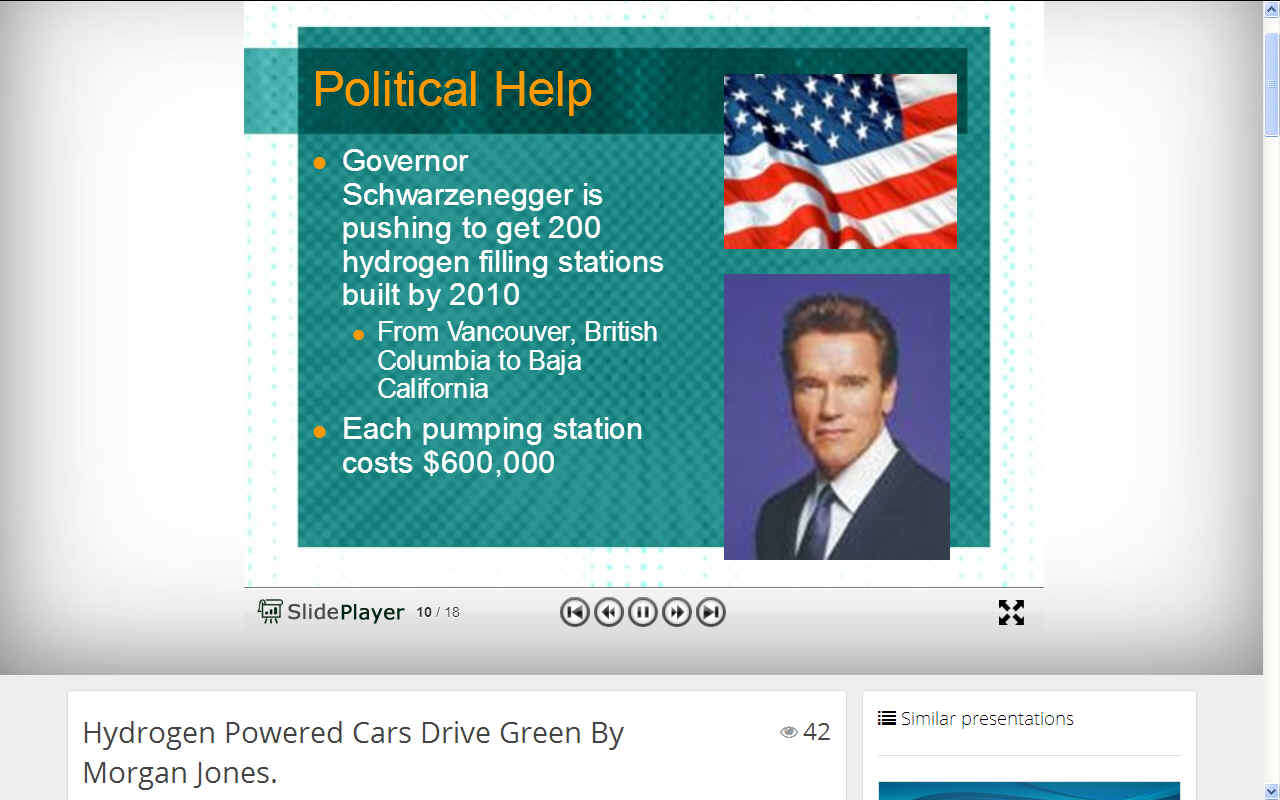

-

California Governor, Arnold Schwarzenegger pushed to get 200 hydrogen filling stations built by 2010 From Vancouver, British Columbia to Baja California Each pumping station

costing an estimated $600,000 at that time.

EUREKA

-

Hydrogen is the most abundant element in the universe. With the "green-energy" craze and talk of powering our future oil-free economy on hydrogen, it has received much attention in the last few decades. Learning about this potential fuel of the future is important and

interesting, but not without snags, and these are for anyone to seek to

overcome.

IN

REALITY:

- You cannot fill up like you do with diesel. It is amazing

how hard it is to fill up a HFC powered vehicle.

-

If this were for a car, you would not even get 100 miles on current tech

hydrogen tanks that are still safe

for passengers and road use.

- Fuel cells wear out

incredibly fast and are hard to regenerate so work out more

expensive.

- Hydrogen as a fuel is

complicated to produce and distribute with acceptably low losses.

ADDITIONALLY:

- Hydrogen fuel cells have bad theoretical and practical efficiency.

- Hydrogen storage is inefficient, energetically, volumetrically and with respect to weight.

- HFCs require a

lot of supporting systems, making them much more complicated and prone to failure than combustion or electric engines.

- There is no infrastructure for distributing or even making hydrogen in large quantities. There

probably won’t be for at least 20 or 30 years, even if we start building it

today like there was no tomorrow.

- Easy ways to get large quantities of hydrogen are not ‘cleaner’ than

fossil fuels.

- Efficient HFCs have very slow response times, meaning you

need additional systems to store energy for accelerating

during docking and leaving port.

- Even though a HFC-powered

ship is essentially an electric vehicle, the additional weight

and volume of water conversion apparatus on board a ship, mean

that using solar panels to harvest free energy is impractical.

-

Solar and wind charged battery electric vehicles are a better

bet given the speed of technological developments past, present and future.

ANIMATION

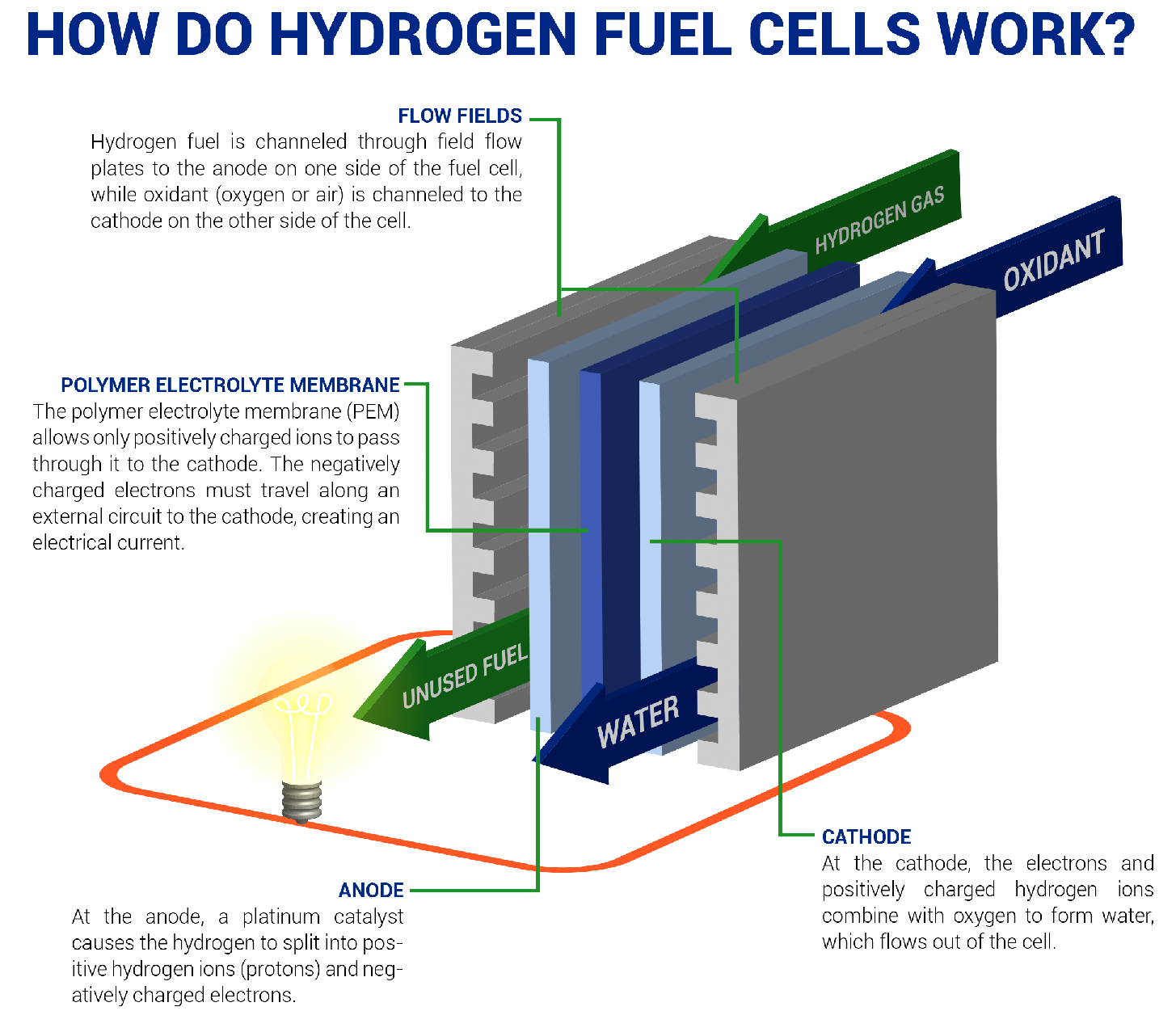

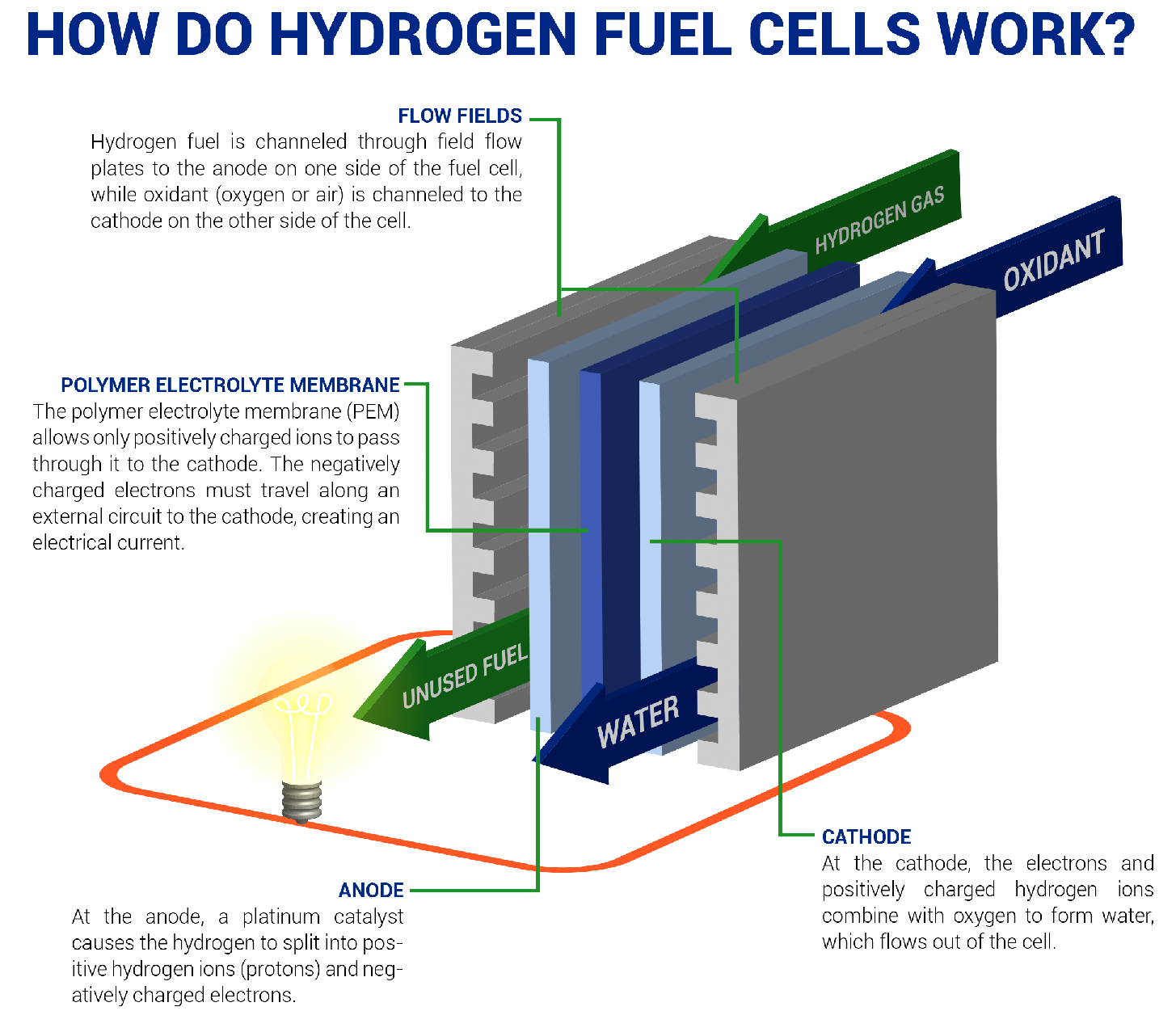

- A fuel cell converts the chemicals hydrogen and oxygen into water, and in the process it produces electricity.

The other electrochemical device that you may be familiar with is the battery. A battery has all of its chemicals stored inside, and it converts those chemicals into electricity too. This means that a battery eventually "goes flat" and you have to recharge it.

With a fuel cell, chemicals constantly flow into the cell so it never goes flat - as long as there is a flow of chemicals into the cell, the electricity flows out of the cell. Most fuel cells in use today use hydrogen and oxygen as the chemicals.

The problem with fuel cells is the storage technology. Batteries are the storage

medium and supply all in one. Fuels cells need an external container to hold liquid hydrogen or hydrogen combined as a metal

hydride to feed the unit that combines the gases to make electricity.

If you

take a solar panel and use the energy from that to charge a battery pack directly, compared to trying to split water, take the hydrogen, dump the oxygen, compress the hydrogen to an extremely high pressure (or liquefy it) and then put it in a

ship and run a fuel-cell, the conversion chain is about half the

efficiency.

What a waste. In climate change terms why would you do that? It makes no

sense, except that there is a theoretical surplus of

generating energy, and hydrogen provides ample ranges for

electrically powered vehicles.

“The entire process of electrolysis, transportation, pumping and fuel-cell conversion would leave only about 20 to 25 percent of the original zero-carbon electricity to drive

a motor.” But in an EV or plug-in hybrid, “the process of electricity

transmission, charging an onboard battery and discharging the battery would leave 75 to 80 percent of the original electricity to drive

a motor.” So the hydrogen ship or car s more like one third as efficient as the

solar/battery EV.

Why would anyone go to all the trouble of creating a premium solution with zero-carbon electricity

- only to throw away most of it as part of some elaborate hydrogen

Fuel Cell Vessel (FCV) scheme. When it comes to vessels, ships

should perhaps incorporate solar and wind energy.

The

introduction of energy efficiency measures and speed reduction are

the only practical means of reducing GHG emissions for most existing vessels. Retrofitting

to use less carbon intensive fuels is possible, but usually very costly. Very few vessels are therefore

expected to undertake such conversion projects. Especially if

there is a scrappage scheme in the making.

HYDROGEN

FUEL CELL CARTRIDGE - It looks like a battery cartridge. It performs

like a battery cartridge. It stores energy like a battery cartridge, but it

is a hydrogen fuel store and fuel cell cartridge combination. Where lithium

and cobalt raw materials may limit the production numbers of EVs as green

motoring becomes the norm, hydrogen in a safe format might offer unlimited

possibilities. The concept is compatible with SMARTNET

FASTCHARGE service stations. NOTE: This is just a concept, not a product

yet. More development is needed to before mass production could be

entertained.

FOOL

CELLS

Tesla co-founder and CEO

Elon Musk has dismissed hydrogen fuel cells as “mind-bogglingly stupid,” and that is not the only negative thing he has had to say about the technology. He has called them “fool cells,” a “load of rubbish,” and told Tesla shareholders at an annual meeting years ago that “success is simply not possible.”

Musk found a surprising source of support in 2017, when Yoshikazu Tanaka, chief engineer in charge of the

Toyota

Mirai, told Reuters, “Elon Musk is right — it’s better to charge the electric car directly by plugging in.” But the Toyota executive added that hydrogen is a viable alternative to gasoline. Toyota chairman Takeshi Uchiyamada told Reuters at the same Tokyo auto show in 2017, “We don’t really see an adversary ‘zero-sum’ relationship between the EV (battery powered electric vehicle) and the hydrogen car. We’re not about to give up on hydrogen electric fuel-cell technology at all.”

The auto industry as a whole has not embraced Musk’s battery-or-bust vision of the future. A 2017 survey of 1,000 senior auto executives conducted by KPMG found they believe hydrogen fuel cells have a better long-term future than electric cars and will represent “the real breakthrough” (78 percent), with the auto executives citing the short refueling time of just a few minutes as a major advantage. Sixty-two percent told KPMG that infrastructure challenges will result in the battery-powered electric vehicle market’s undoing.

In California, debate continues over whether the subsidies offered by the state to jump-start the fuel cell market have paid back the investment as judged by the limited use of refueling stations and lack of profits. California is committed to the effort begun under former Gov. Jerry Brown to fund renewable energy initiatives, which included a $900 million zero-emissions vehicles plan and funding for

electric vehicle charging infrastructure, including 200 hydrogen stations by 2025.

HIGH

PRESSURES, LOW TEMPERATURES

Compressed hydrogen can be stored on board in tanks based on type IV carbon-composite technology, an all-composite construction featuring a polymer, liner (typically a high-density polyethylene

(HDPE)) with carbon fibre or hybrid carbon/glass fibre composite. The composite materials carry all of the structural loads. The pressures used are usually either 350 bar or 700

bar (5-10,000 psi).

Capacities vary between manufacturers, but 5 kg is typical. The design and engineering of these tanks has delivered dramatic improvements over the past 10 years.

Such tanks are ideal for incorporation in specially designed packs

or cartridges to suit most EV platforms.

Hydrogen is also stored in cryogenic conditions in insulated tanks (typically cooled to -253°C and at pressures of between 6 and 350 bar), or using advanced materials,

(ie within the structure or on the surface of certain materials).

Equally, such methods lend themselves to incorporation in cartridges of the

same physical dimensions as pressurized tanks, or, for that matter, battery

packs.

Higher purity hydrogen is required for use in fuel

cells, an issue that needs to be addressed. Filling stations could process at distribution

centers, or locally, using using pressure swing absorption (PSA) or molecular sieve technologies in conjunction with the high pressure compressors that would be needed.

This may allow for easier distribution.

BACK

TO BASICS - ELECTROLYSIS

A

water molecule is formed by two elements: two positive Hydrogen ions and one negative Oxygen ion.

The water molecule is held together by the electromagnetic attraction between these ions. When

electricity is introduced to water through two electrodes, a cathode (negative) and an anode (positive), these ions are attracted to the opposite charged electrode. Therefore the positively charged hydrogen ions will collect on the cathode and the negatively charged oxygen will collect on the anode.

When these ions come into contact with their respective electrodes they either gain or lose electrons depending on there ionic charge. (In this case the hydrogen gains electrons and the oxygen loses them) In doing so these ions balance their charges, and become real, electrically balanced, bona fide atoms (or in the case of the hydrogen, a molecule).

The reason this system isn't very efficient is because some of the electrical energy is converted into heat during the process.

ANYTHING BUT OIL

In summary, until oil becomes more

expensive, motorists will have little or no incentive to switch to battery or fuel-cell

vehicles. We might stick with internal combustion

engines, but power them with biofuels, except that we need the land to grow crops, and forest

(fires) clearing for such use is causing

global warming. Or it might turn out more efficient to build

electric cars with onboard

batteries that you charge up at home.

A-Z

INDEX OF H2 POWERED FUEL CELL SHIPS

BOREAL

SJO

FCS

ALTERWASSER

HYSEAS

III

NORLED

SAN

FRANCISCO BAY

SANDIA

& DNV-GL

SCANDLINES

VIKING

LINE

TRANSFERABLE

TECHNOLOGY - The design of the Climate Change Challengers

might be adapted to Cargo, Container, Cruise and Ferry

designs, without needing to radically alter port facilities.

The designs above are not representative of adaptations of the

concept, but serve to illustrate the thinking of other design

houses.

LINKS

& REFERENCES

H2020

manual

UK

H2020 contacts

Horizon

Europe

https://www.iter.org/

https://hondanews.com/releases/shell-in-collaboration-with-honda-and-toyota-to-bring-seven-new-hydrogen-refueling-stations-in-california

https://www.cnbc.com/2019/02/21/musk-calls-hydrogen-fuel-cells-stupid-but-tech-may-threaten-tesla.html

https://www.cnbc.com/2019/02/26/how-toyota-is-helping-japan-create-a-hydrogen-fueled-society.html

https://www.ft.com/content/98080634-a1d6-11e7-8d56-98a09be71849

https://www.explainthatstuff.com/fuelcells.html

http://www.blue-growth.org

PEMFC

- Polymer exchange membrane fuel cell (PEMFC)

- The Department of Energy (DOE) is focusing on the PEMFC as the most likely candidate for transportation applications. The PEMFC has a high power density and a relatively low operating temperature (ranging from 60 to 80 degrees Celsius, or 140 to 176 degrees Fahrenheit). The low operating temperature means that it doesn't take very long for the fuel cell to warm up and begin generating electricity.

Please use our A-Z

INDEX to navigate this site

AMMONIA

- COMPRESSED

GAS - ECONOMY - FUEL

CELLS - FUSION

- HYDRIDES

- LIQUID GAS

- METHANOL

|