|

COAL

ADDICTION & COLD TURKEY

Please use our

A-Z

INDEX to navigate this

site where pages may link to other sites

IT

KILLS US GETTING IT OUT -

Mining is traditionally a dangerous occupation. If a mine

collapse does not get you, the carcinogenic dust will do you

no good either. And then there is global warming, that will

get your children and

grandchildren for sure.

Despite the health risks, politicians cannot wean themselves

off it, they are dependent on the Black Death, to prop up

their unsustainable policies. It is more addictive than

cocaine for our world leaders, who are weak leaders, unable to

procure hydrogen, or any other clean substitute. Even though

they've had 40 years or more to do so.

When

you think coal, think about China

upping their production of coal fired power plants by 235 GW.

They were also involved in another 102 GW of construction

overseas, until Xi Jinping called that off.

Coal

is natures carbon capture. It makes no sense to release that

carbon, then spend more energy trying to capture it. That is

crazy economics and unsustainable thinking in a world where UN

members have signed up to the concept of a Circular

Economy.

Coal

is dirty in many ways. Goods produced from the energy released

by burning coal, are dirty. China will not attend COP26 in

Glasgow, a signal to other world leaders of their intentions -

and they know they will not agree to anything meaningful.

Neither will India, but at least they attended.

WHY

WON'T MAJOR COAL-DEPENDENT COUNTRIES SIGN ON TO PHASE-OUT

DEAL? - November 10, 2021

The future of coal is playing a big role at the ongoing United Nations Climate Change Conference of the Parties (COP26) in Glasgow. In the run-up to the climate conference, UK prime minister

Boris Johnson and

Alok

Sharma, president of COP26, called on countries to “consign coal to history.” But the negotiations at COP26 are showing us just how hard that will be.

The need to reduce coal emissions to meet climate targets is clear. The International Energy Agency’s recent Net Zero by 2050 report indicates that coal needs to be phased out in advanced economies by 2030 to keep 1.5°C in sight and in non-Organization for Economic Cooperation and Development (OECD) economies by 2040. A famous 2015 paper in Nature found that 80 percent of coal reserves will need to be left in the ground between 2010 and 2050 to keep global warming well below 2°C. Without a rapid phaseout of coal emissions, the goals of the Paris Agreement will be difficult to meet.

In the first week of COP26, the United Kingdom declared that the end of coal is in sight as 46 countries (and several organizations) have made commitments to phase out unabated coal power. This includes OECD countries like Germany, Poland, South Korea, and France and emerging economies like Indonesia and Vietnam. Additionally, South Africa recently signed an $8.5 billion partnership deal with the United States, United Kingdom, France, Germany, and the European Union to accelerate a coal phaseout. Another group including the United States and several European countries and banks pledged to end the finance of unabated fossil fuel infrastructure by 2022.

Despite these pledges, the United Kingdom has had trouble getting major coal producers or consumers including China, India, and Australia to sign on to its coal phaseout pledge. These economies collectively produce and consume around two-thirds of global coal. While the economy of each country is quite different, the role that coal plays in each creates similarities that need to be understood before a global approach to coal can be achieved.

CHINA

China’s energy and socioeconomic imperatives appear to outweigh climate considerations.

China is the world’s largest producer and consumer of coal, where the resource accounts for about 57 percent of the primary energy supply and a little over 60 percent of the electricity supply today. Coal extraction and its use in power plants are run by state-owned coal companies, which have long enjoyed strong influence on local politics through job provision and tax revenues. For example, coal-related industries in coal-rich Shanxi contributed 29 percent of its GDP and 46 percent of its tax revenues in 2018. For China as a whole, 3.21 million people have direct coal jobs.

Despite attempts from the central government to reduce reliance on the coal sector for economic growth, recent power shortages have led to a coal resurgence. After experiencing waves of power shortages resulting in rolling blackouts in households and factories operations, the Chinese government has called for greater coal production and coal-power generation as well as more bank lending to mines and power plants. The government loosened its control on coal-power pricing, which had been a key factor behind the power crisis, alongside the global demand recovery for Chinese manufacturing and coal supply shortages. The tighter control over coal-power pricing had disincentivized power generators from increasing output, as market-based thermal coal prices climbed even while the coal-power prices remained low.

Even before the current severe power shortage, China was already building roughly 88 gigawatts (GW) of additional capacity to expand its 1,080 GW coal-fired power fleet, which is about five times the installed coal-fired power capacity in the United States. Whether the coal revival is a blip or a long-term departure from the country’s climate mitigation track is a question with profound climate implications.

INDIA

Coal is a mainstay of India’s energy system, where it accounts for over 50 percent of the country’s primary energy consumption and 70 percent of electricity generation. The Indian investment in coal has been recent; over 50 percent of India’s coal power plants were built in the last decade and the weighted-average age of all coal plants in India is only 13 years (compared to over 40 years in OECD countries). Most of these power plants were funded by state-owned banks who have lent billions for construction of these plants and are likely to resist any early coal plant closures.

Currently, India is the second-largest coal importer after China. Yet, India also has massive coal reserves that it wants to harness to provide reliable power for people and industries. While most of the coal production is undertaken by state-owned coal companies, the Modi government has started auctioning mines to private companies. This policy is meant to reduce India’s reliance on coal imports by increasing domestic production. Joining a coal phaseout deal will mean immediate backtracking from the coal mines auction policy, which will have a domestic political fallout that the current government may not be ready to make.

Beyond the energy imperatives, coal is a source of jobs and revenues regionally. At least six states in India are dependent on coal for revenues. Nearly 40 percent of Indian districts are dependent on the coal sector for jobs, revenues, or corporate social responsibility spending projects like building and running schools. The industry provides jobs to four million Indians directly or indirectly, making the politics of coal phaseout remarkably challenging.

AUSTRALIA

Australia is unique among the world’s richer nations for its reliance on commodity exports and the role coal plays in its domestic politics. The island nation is the world’s largest coal exporter, accounting for almost a third of global trade in the carbon-intensive commodity. Among G20 nations, Australia produces the second-most fossil fuels per person, after only Saudi Arabia, and five times as much coal per person as the next closest country, South Africa.

The net result is a political economy environment deeply skewed by the trajectory of coal in the global energy supply. The political debate over climate change has been mired in a rural-urban culture war for more than a decade. Australia’s conservative prime minister,

Scott

Morrison, famously brought a lump of coal into parliament in 2017, telling his opponents, “This is coal, don’t be afraid of it.” More recently, Australian climate advocates funded a “Coal-o-phile Dundee” billboard in New York’s Times Square, attacking the prime minister for his pro-coal stance. The debate has significant electoral implications domestically, with several swing districts being heavy coal-producing areas.

While the government has announced a plan to reach net-zero emissions by 2050, existential questions over Australia’s energy and economic future loom large. Despite one of the world’s fastest increases in renewable electricity generation, coal still accounts for 54 percent of the country’s total electricity supply and more than two-thirds in the populous (and politically dominant) states of Queensland, Victoria, and New South Wales. Many parts of the country have suffered from large spikes in electricity prices in recent years, thanks to an insufficient domestic supply of natural gas, ratcheting up the political pressure to maintain stable prices and keep otherwise dubious coal assets afloat.

Finally, it is not clear what Australia’s economic future would look like in a low-carbon world. The country has always been a commodity exporter, and its leaders seem to lack the imagination to see how that could change. It’s not hard to see why. China’s extraordinary demand for Australia’s iron ore and coal have underpinned the longest period of uninterrupted growth on record. Much as Australia’s leaders didn’t see China’s rise coming and had to scramble to meet growing demand for its exports, the clean energy transition will likely come as a rude shock. The country has managed to transition from one commodity cycle to the next before, but it has little history of leading from the front. Given these political, energy, and economic imperatives, Australia is extremely unlikely to be party to any coal phaseout deal at COP26.

Conclusion

China, India, and Australia are vastly different in just about every facet of economics and politics, but they share one thing: an addiction to coal. The Paris Agreement recognized in 2015 that domestic politics trumps all else in global climate negotiations, and that understanding needs to extend to how the UN negotiations address coal. For countries where coal mining, export, or combustion remain integral to the energy and socioeconomic systems, coal phaseout is still a question of whether, rather than when.

Ultimately, a combination of market economics, investor confidence, and technological substitutes will facilitate the decline of coal. Yet, it is not just unrealistic, but naïve, to expect countries for whom coal occupies such a key political-economic position to operate otherwise.

Many

world leaders should have to hang their heads in

shame on the world stage, as they cling to disgusting economic

policies, rather than join other nations to forge a clean new

world. Ignoring for now the human

rights abuses, where burning coal in one geographical

location, takes lives in another.

Purchasing

goods from any country that is accelerating coal burning is

like adding to global warming.

In buying goods from a country that is turning its back on climate

change, it is encouraging them to keep on stepping on the

fossil fuel gas pedal, so accelerating climate

change, instead of changing to clean hydrogen

tech, and replanting

trees, to make up for years of deforestation.

There

is a reason Chinese and Indian goods are cheap, because they

are produced without paying any penalty for polluting the

atmosphere with greenhouse gases. So are they

cheap, if such imports are warming the planet and creating deserts

of agricultural

land? No. Of course not. The penalty for buying cheap imported

goods, is global warming.

Countries

that export coal to other nations who use it to fuel

unsustainable economies, are just as bad as the country doing

the burning. They are inciting others to commit climate crime.

Coal should be left where it is, in the ground.

ALL

TALK NO ACTION -

Some world leaders give such good speeches, that their

followers actually believe their gaslighting. Whereas, they

have no plan at all to recover planet earth from the fry up we

are heading toward. A smart

networked infrastructure is lacking for electric vehicles

and ships. We gave up coal for steamships years ago in favor

of heavy

bunker fuel oil, that is almost as polluting. But clean hydrogen

has been skirted around instead of embraced. While politicians

stumble on with the same old promises they were making in

2000. And it is your fault, because you voted them in. In

China, they do not have a vote. Who is worse, a democracy

built on false promises, or communism where there is no choice

but the party line. At least with China, you know where you

are. In the West, we look through rose colored spectacles at Bojo's

clowning antics.

Using

coal is at the expense of sinking Pacific

islands and melting the ice

caps, not to mention killing

thousands of species every year and acidifying the

oceans.

The

USA

under Trump was just as bad as China under Xi Jinping, except

that Donald was more oil

and gas addicted. Fortunately, he was voted out for his

ineptitude in politics.

Fossil

fuels kick started our industrial revolution, powered steam

ships and generated electricity as we released the energy in

coal and later oil, to make things happen at a faster pace.

Cars, ships and aircraft being an example of things we now take for

granted that pollute big time, but could all be clean using

renewable electricity.

But

it was a brilliant time for engineers and town planners who

thought they could rely of this energy source without any

consequences. Because after all the world is a big place.

Surely humans could not alter the delicate ecological balance

of planet earth just by driving a few cars and lighting a few

home fires. Then came central heating.

Sh*#%

Sadly,

we can and we do. We did and we still are, even though we now know how

dangerous our excesses are to other species - and we are also

set for extinction if we do nothing to swap

fossil fuels for

clean renewable energy sources.

Nature

found a way to lock up carbon from excess energy that was

pouring onto the earth's surface in producing coal. Coal is a

natural carbon sink like wood,

except more compressed.

Man

was stupid enough to burn the coal to unlock the carbon that

nature had locked up for him.

How

brainless is that? Convenient, but really dimwitted.

Nature

used leaves and algae to capture energy from the sun and

convert that into plant matter. This is called photosynthesis.

It is the basis of all life on

earth.

HOW

IS COAL FORMED?

Coal formed millions of years ago when the earth was covered with huge swampy forests where plants - giant ferns, reeds and mosses - grew. As the plants grew, some died and fell into the swamp waters. New plants grew up to take their places and when these died still more grew. In time, there was a thick layer of dead plants rotting in the swamp. As

water and dirt covered the dead plants, the decaying process was stopped. More plants grew up, but they too died and fell, forming separate layers. After millions of years many layers had formed, one on top of the other. The weight of the top layers and the water and dirt packed down the lower layers of plant matter. Heat and pressure produced chemical and physical changes in the plant layers which forced out oxygen and left rich carbon deposits. In time, material that had been plants became coal.

Coals are classified into three main ranks, or types: lignite, bituminous coal, and anthracite. These classifications are based on the amount of carbon, oxygen, and hydrogen present in the coal. Coal is defined as a readily combustible rock containing more than 50% by weight of carbon. Coals other constituents include

hydrogen, oxygen, nitrogen, ash, and sulfur. Some of the undesirable chemical constituents include chorine and sodium. In the process of transformation (coalification), peat is altered to lignite, lignite is altered to sub-bituminous, sub-bituminous coal is altered to bituminous coal, and bituminous coal is altered to anthracite.

LIGNITE

Lignite - is the lowest rank of coal - which means that it has the lowest heating value and lowest carbon content. Although lignite is more solid than peat it crumbles when shipped long distances. Most lignite in the U.S. is in North and South Dakota, Montana, and Texas. Lignite is used to generate electricity. Other uses include generating synthetic natural gas and producing fertilizer products.

BITUMINOUS

Bituminous - is intermediate in rank and sometimes called soft coal. It appears smooth when you first see it, but look closer and you'll find it has many layers. It is the most abundant kind of coal. It has a high heating value, but it also has a high

sulfur content. More than 80% of the bituminous coal produce in the U.S. is burned to generate electricity. Other major coal users are the cement,

food, paper, automobile, textile and plastic industries. Another important industrial use is to provide coke for iron and

steel industries. Bituminous coal derivatives, or by-products can be changed into many different chemicals form which we can make paint, nylon, aspirin and many other items.

ANTHRACITE

Anthracite - is the highest rank of coal which means that it has the highest heating value and highest carbon content. It is very hard, deep black, and looks almost metallic because it is brilliantly glossy. Anthracite burns longer, with more heat and with less dust and soot than other types of coal. The primary market for anthracite

was for heating homes.

Oil

is also one of natures way of locking up energy from the sun.

Mankind

needs to tap into the incoming solar energy directly, rather

than unlock the carbon that is safely tucked away for a rainy

day or two.

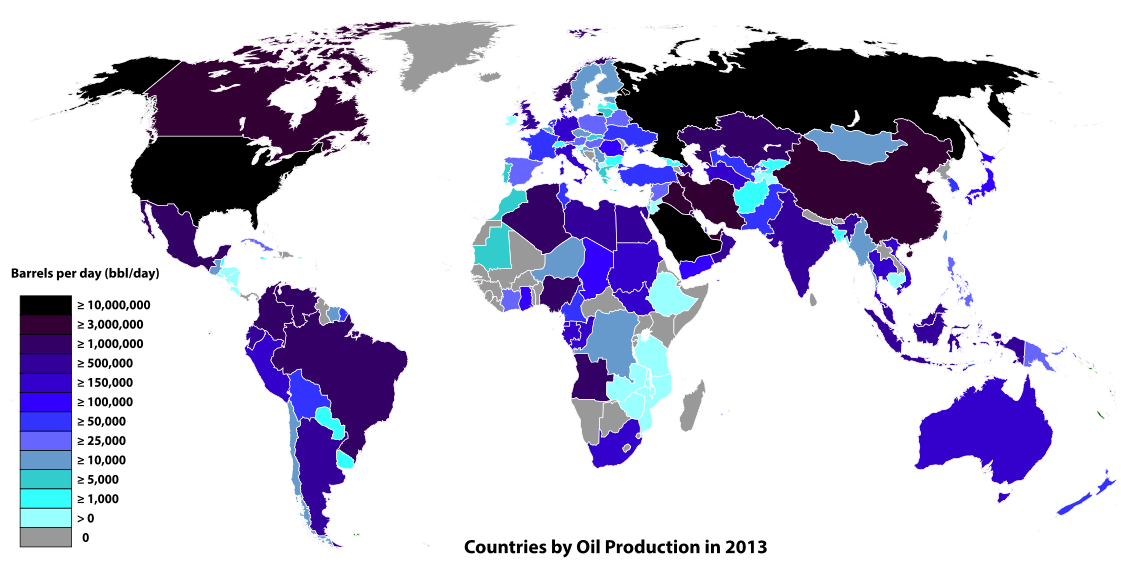

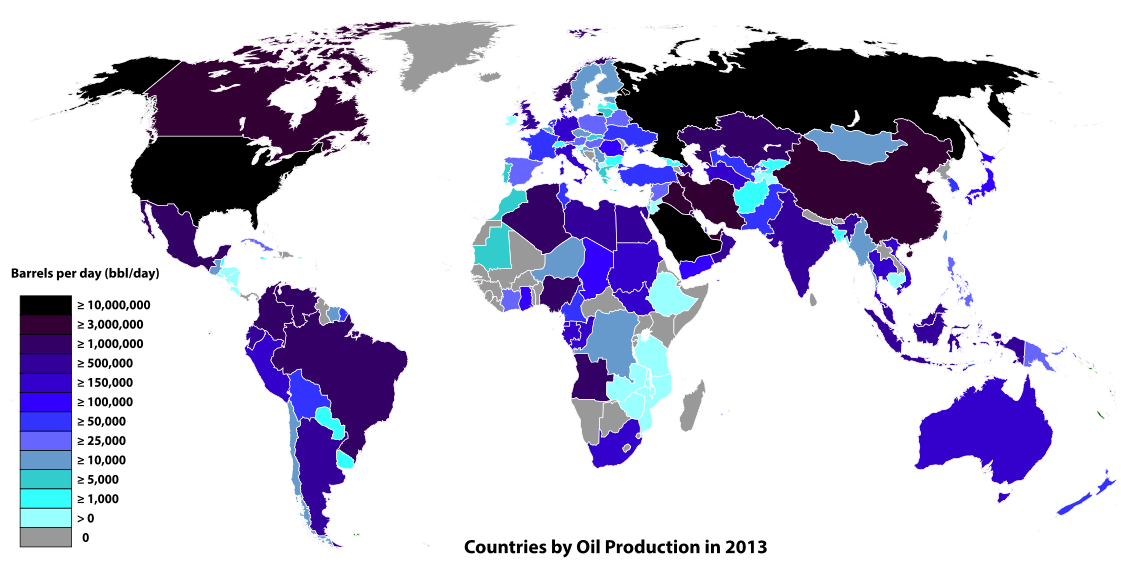

Map

of the world showing oil consumption as colour codes.

HIGH

END USER ADDICTION

By way of an example, the United States

has less than 5% of the world's population, but uses more than 25% of the world's supply of fossil

fuels derived from oil. As the largest source of U.S. greenhouse gas emissions,

CO2 from

fossil fuel combustion, accounted for 80 percent of [its] weighted emissions in 1998. Combustion of

fossil fuels also produces other air pollutants, such as

nitrogen

oxides, sulfur dioxide, volatile organic compounds and heavy metals.

The more developed a country in 2019, the harder it will be to

kick the fossil fuel habit. Going cold-turkey is not an

option. President

Donald Trump was an oil addict, but Joe Biden looks to be

a better bet, swayed by his conscience, and other G20

world leaders are sure to be considering ways of curing their

nation's addiction to oil, before they

overdose.

THE

CONVERSATION & ENERGYPOST.EU

18 OCTOBER 2021 - China’s energy crisis: the problems with coal exit, emissions targets, and a command economy

China is also suffering from an energy crisis. Major industries have had to restrict production, and reports abound of candle-lit dinners, traffic lights failing and people getting trapped in elevators. Its effect has also been global, with Apple, Tesla, Microsoft and Dell saying it’s hitting their supply chains. As Jun Du at Aston University explains, China’s drive to cut coal has collided with post-Covid resurgent demand and an unusually hot summer that hit

wind and hydro generation. It’s been exacerbated by the peculiarities of China’s command economy, where strict emissions targets and state-controlled energy prices have driven provincial leaders to cut coal generation even though demand for power is rising.

To get through this crisis, a sudden time-limited reversal of policy will see coal use rise to end the power cuts, inevitably adding to emissions. Du summarises the causes of the crisis, and the lessons that can be learned. Clearly, its heavy coal dependence – still responsible for two-thirds of its electricity – means rapid emissions reduction makes its economy and supply chains vulnerable to power cuts when there is an energy shock. Its command economy and price-setting doesn’t allow the market to fix itself. The good news is that China seems serious about emissions reduction: it’s aiming to cut energy intensity by 13.5% by 2025, carbon emissions per unit of GDP by 18%, and reach peak emissions by 2030. But for China – and no doubt other nations – cutting emissions too fast without the replacement clean power in place can result in shut-downs, emergency policy reversals and more emissions.

As the world prepares to discuss more aggressive cuts to carbon emissions at the UN’s

COP26 climate conference in Glasgow, China has just sent out the worst possible advance signal. It is going to loosen restrictions on coal mining in the final three months of the year in response to an energy crisis which has seen nationwide blackouts and many manufacturers shutting down production lines in recent weeks.

China will now extract more coal in 2021 than the 3.9 billion tonnes it extracted in 2020, as well as quietly importing more from places like Australia. The move flies in the face of President Xi Jinping’s strong rhetoric about decarbonisation, including a very recent commitment to stop building coal-fired power stations in other countries. And it raises questions about the nation’s ability to make good on the tough carbon reduction targets in its 14th five-year plan to 2025.

So how did China get into this situation, and what does it mean for the world’s efforts to reach net zero?

BOOM

& BUST -

Having raised the price of building materials around the

world, the Chinese property giant Evergrande is suffering under an enormous pile of debt, reportedly worth US$305 billion (£220 billion). There have been angry protests at its headquarters, shares have tumbled, and the eyes of the financial world remain anxiously focused on its future.

Put simply, the situation at Evergrande is dire. They do not

build affordable, sustainable homes.

The immediate impact of Evergrande’s troubles will be on China’s once booming property market. The sector represents 7.3% of the country’s GDP compared to 4.1% in 2000. It is a market which been over-expanding for many years, with the debt level of other big development firms already very high. If Evergrande were to collapse, it would cause a domino effect across the sector, potentially leading to the demise of more businesses.

Indeed, the China Chenxin Credit Rating Group (CCXIS) has already downgraded the outlook of China’s property sector to negative. This change makes it even more difficult for those companies to raise funds, exacerbating the debt situation and making borrowing more expensive.

Beyond the world of property, the collapse of Evergrande would have major ramifications in other sectors it is involved with, including consumer electronics, building materials, furniture and electric cars.

WHY THE LIGHTS WENT OFF

China has a so-called dual control target for national environmental protection, which is about cutting both energy consumption and the amount of energy that goes into each unit of GDP (known as energy intensity). Having made impressive strides forward in the 2015-20 period, China is now aiming to cut energy intensity by 13.5% by 2025 and to cut carbon emissions per unit of GDP by 18%, with a view to bringing overall carbon emissions down by 2030.

To this end, China has been cracking down on coal, which still generates around two-thirds of its electricity. The state has been shutting down small and inefficient mines and putting restrictions on coal production. Consequently, coal output has been falling in many months in 2021, while coal imports were also low.

But this drove up the price of coal, and electricity-generating companies could not pass on the costs to consumers because of national price caps. Faced with generating electricity at a loss, major players have simply stopped producing.

[In the UK, several energy suppliers have gone bust]

To make matters worse, China has had an exceptionally hot summer (which itself is being blamed on climate change). The dry windless weather has meant that China’s wind and hydroelectric power have been generating less electricity than usual. The result has been outages that have seen many families reduced to candle-lit dinners, traffic lights failing, and unlucky people getting trapped in elevators between two floors.

PROVINCIAL EMISSIONS TARGETS, DEADLINES

Meanwhile, provinces have been given specific targets and deadlines to help achieve the emissions targets, many of them related to electricity consumption. Beijing “name and shames” laggard provinces with yellow (bad) and red (very bad) alerts, represented by triangles in the map.

As with other hard targets in China, missing them can have serious implications for a local official’s career prospects. So in response to these alerts, several provinces have been imposing electricity usage restrictions, particularly on companies in energy-intensive industries like steel, printing, textiles, wood, chemicals,

plastics and goods manufacturing. In many cases, companies were indiscriminately told to restrict production to two or three days a week – compounding the problems from generating companies shutting down power.

Coming at a time when demand for Chinese-made products has been rising sharply because global consumer spending is recovering from the pandemic, this is one more hit to global supply chains. They are already having to deal with too few semiconductors, workers, containers and ships – to name only a few. Apple,

Tesla, Microsoft and Dell are among the big names saying their supply chains are now also being hit by China’s energy crisis.

[So why are they investing in China, could Michael Dell and

Elon Musk not see this coming, in the race

to space]

CHEAP

IMPORTS -

It's no longer a bowl of rice a day in China, they want

western luxury, executive cars instead of cycles and rickshaws

- and worst of all - military might. Set against this

developing scenario, why are so many big players having goods

Made in China? Imports are not cheap if you are pushing out

masses of CO2 into the atmosphere, because of the cost to our

environment. Goods from China that can be certified made using

renewable electricity, and zero emission transport - now

that's a whole new ballgame. Xi Jinping will not attend COP26,

where he will be told off by Greta

Thunberg for sure.

At

the UN General Assembly 2021, Xi Jinping announced that China “will not build new coal-fired power projects abroad”.

Chinese banks have already swung into gear. Three days after Xi’s speech, the Bank of China declared it would no longer provide financing for new coal mining and power projects outside China from the last quarter of 2021.

Xi’s statement is expected to affect at least 54 gigawatts of proposed China-backed coal plants that are not yet under construction. Shelving these would save CO₂ emissions equivalent to three months of global emissions.

This pledge from the world’s largest public financier of overseas coal plants could usher in a new era of low-carbon development. But that depends on what happens in the countries where China had funnelled money into coal power. Many of these places urgently need new energy infrastructure. Will China’s investments here be redirected to renewable energy – or simply disappear?

Beijing has supported wind and solar projects in more than 20 developing countries since 2013, including Ethiopia and Kenya.

Chinese banks and companies have also expanded their overseas investments in renewable energy over the last decade.

Why not then at home?

THREE LESSONS

Not only is China loosening restrictions on coal production for the rest of 2021, it is making special bank loans available for mining companies and even allowing safety rules in mines to be relaxed. This is having the desired effect: on October 8, after a week in which the markets have been closed for a national holiday, domestic coal prices promptly dropped by 5%. This will presumably ease the crisis as the winter approaches, notwithstanding the government’s embarrassment going into

COP26. So what lessons can be learned for the road ahead?

1. Supply chains are fraying

Since the disruptions to global supply chains caused by COVID abated, the mood has been one of getting back to normal. But China’s power struggle illustrates how fragile they can still be. The three provinces of Guangdong, Jiangsu and Zhejiang are responsible for nearly 60% of China’s US$2.5 trillion (£1.8 trillion) exports. They are the nation’s biggest electricity consumers and are being hardest hit by the outages.

In other words, so long as China’s economy (and by extension the global economy) is so dependent on coal-fired power, there’s a direct conflict between cutting carbon and keeping supply chains functioning. The net zero agenda makes it very likely we will see similar disruptions in future. The businesses that survive will be the ones that are prepared for this reality.

2. Command economies have drawbacks

In China, the fixed electricity price cap prevented prices from rising even when it meant producing electricity at a loss. The power shortages have seen some big manufacturers surviving by hiring private generators (meaning more carbon emissions), while smaller players who can’t afford generators have been unable to fulfil orders and are going bust. With large manufacturers looking to recoup the cost of hiring generators, and fewer goods being exported overall, global consumer prices will go up.

ontrast this with a market economy like the UK, which is having its own energy crisis because of high gas prices. It too has consumer price caps for electricity, but it has been quicker to allow them to rise. This won’t save many smaller energy providers, who have too many customers on unprofitable fixed-tariff contracts and don’t own any of the energy network, so can’t offset their losses by wholesaling energy to other providers at more expensive prices. Businesses and consumers are going to suffer too from higher energy bills, but there are no power cuts so overall the disruption to the economy is much less.

3. China is serious about decarbonisation

Despite its temporary climbdown over coal-mining, China’s resolve over decarbonisation is worth commending. As pointed out by analysts at Nomura bank: “Beijing’s unprecedented resolve … could result in invaluable long-term gains, but the short-term costs to both the real economy and financial markets are substantial.”

In short, the world is facing a real crisis. The consequences from climate change are appearing more frequently than before. Yet for all the exciting low-carbon technologies, we are still some way from being able to rely on them to cut carbon emissions without undermining the economy. The good news is that at least many countries including China are now committed to cutting emissions and are willing to collaborate to achieve this. Whatever the difficulties ahead, collaboration is surely the key to net zero.

By Jun Du Professor of Economics, Centre Director of Centre for Business Prosperity (CBP), Aston University

THE

DIRTIEST DOZEN - A TO Z WORLD'S WORST POLLUTERS

|

Chinese

President

Xi

Jinping

|

US

President

Joe

Biden

|

EU

President

Ursula

von der Leyen

|

Indian

PM

Narendra

Modi

|

|

Vladimir

Putin

Russian

PM

|

Japanese

PM

Fumio Kishida

|

Kim

Boo-kuym

South

Korean PM

|

Mohammed bin Salman

Saudi

Arabian Ruler

|

|

Justin

Trudeau

Canadian

PM

|

Jair Bolsonaro

Brazilian

PM

|

Joko Widodo

Indonesian

PM

|

Scott

Morrison

Australian

PM

|

LINKS

& REFERENCE

https://www.csis.org/analysis/why-wont-major-coal-dependent-countries-sign-coal-phaseout-deal

https://theconversation.com/chinas-energy-crisis-shows-just-how-hard-it-will-be-to-reach-net-zero-169478

https://energypost.eu/chinas-energy-crisis-the-problems-with-coal-exit-emissions-targets-and-a-command-economy/

https://www.britannica.com/science/global-warming

This

website is provided on a free basis as a public information service.

copyright © Climate Change Trust 2021. Solar

Studios, BN271RF, United Kingdom.

|